July 4th Sale Ends Friday and How to Understand the UW Flow feed, Straddles, and Rolls

Learn for free as part of our weekly free educational series

Hey all,

This the Unusual Whales Team, and we are going to spend every Wednesday walking you through some trades of the week for free to help your trading!

These educational tutorials will be options or equities focused, and be educational to help you understand why or how interesting and useful trades were made. For those interested, we are having a July 4th sale for 15% off if you want to try out the tools!

Today, we’re going to look at some options basics with examples straight from the flow feed, specifically position rolls and a beginner options strategy called a “Straddle”.

Let’s start off with some definitions. An options roll can occur in a few ways ; a roll up, and a roll down. A roll up refers to a trader closing an existing options contract position they are currently in, and simultaneously opening a new position on the same stock at a higher strike. We covered an amazing example of successful options rolling in our previous newsletter following a highly profitable SPY options trader.

Above, we see the trader selling to close the $440 calls for 7/7 (noted by the BID SIDE transaction, with volume less than open interest) and buying to open the $448 call of the same expiry (ASK SIDE transaction, with order size significantly greater than outstanding open interest).

A roll down is the opposite; when a trader closes a position they currently have while simultaneously opening a new position at a lower strike.

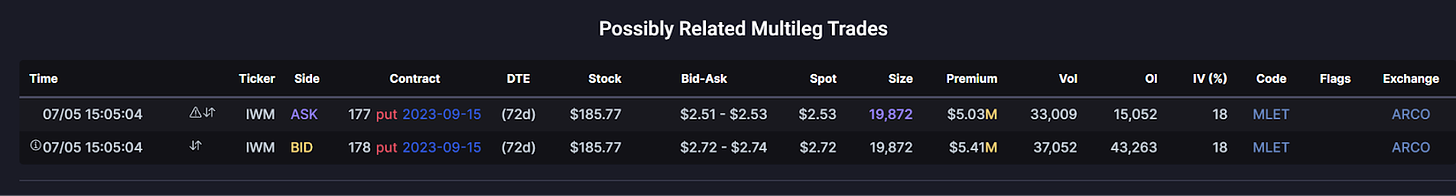

In the example below, we see an IWM trader likely selling to close the $178p for 9/15 and buying to open the $177p for the same expiry.

The third way options rolling can occur is called a roll out. A roll out is when a trader closes a position they currently have while simultaneously opening a new position with a further dated expiry. This can occur in the two ways discussed above (roll up and roll down), but it can also occur on the same strike as the previous position.

Generally, when a trader is rolling up and out on a position, they’re “riding the wave” by taking profit on their first position and buying more time on the new position. When a position on calls is closed and rolled up to a higher strike and further dated expiry, one can speculate the trader has bullish expectations (such as the aforementioned SPY trader)

Often, when a trader is rolling out and staying on the same strike with a further expiration, it’s because their thesis or bias hasn’t changed, but the timeline has, and the underlying stock may not have made the anticipated move yet.

Today’s Newsletter is sponsored by Tradier, the preferred brokerage for options traders.

With Tradier, you can enjoy true COMMISSION FREE trading on equities and options for just $10 per month! No more per-contract, per-transaction fees; for $10 per month, Tradier grants you truly commission-free trading!

By joining the Tradier platform, you will not only become a part of a community, but you will also have the opportunity to learn from and with some of the best with the upcoming Tradier Hub!

No more solo journeys. Aiming to redefine the trading experience by creating an empowering community for traders like you. Embark on a new trading journey marked by a vibrant community, unparalleled learning opportunities, and expert insights.

Secure your spot in Tradier Hub and be the first to get access!

Straddles

Moving on now to the straddle options strategy. A straddle is an options strategy in which a trader buys (or sells) a call and a put of the same strike and expiration. This strategy can be either bullish position (long straddle) where they buy a call and a put, or bearish (short straddle) where they sell a call and a put. NOTE that a short straddle has a high risk of ruin, because it’s hypothetically possible for the value of Calls to rise infinitely, meaning it is technically possible to realize unlimited losses via a short straddle. Let’s take a look at an example of a short straddle on Netflix (NFLX).

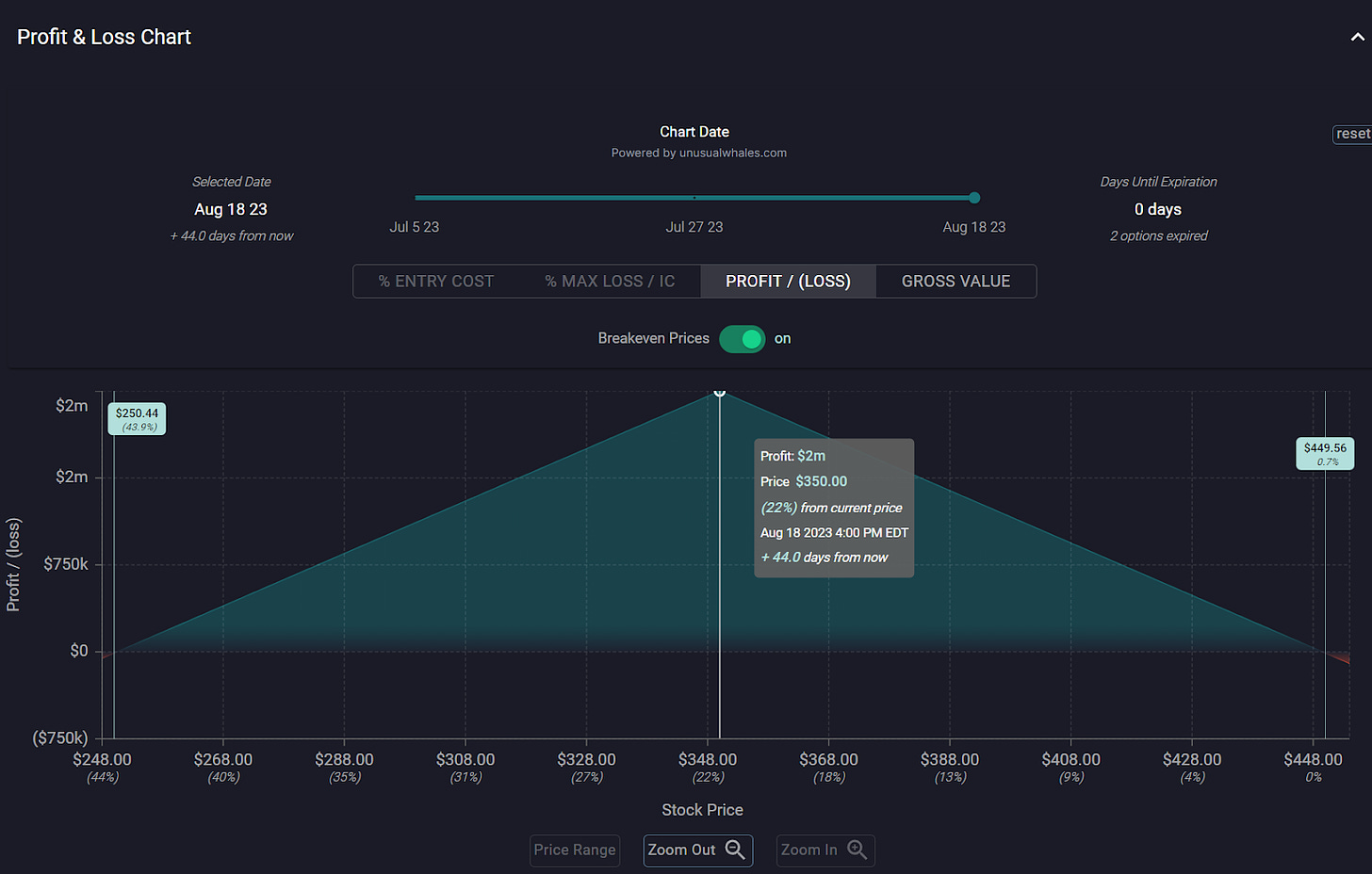

Above, we see our trader entering into a short straddle position by selling to open the $350 call and put for 8/18/2023. The trader receives $95.49 in credit per contract on the calls, and $2.49 per contract on the puts, for a total credit of $2,214,348.

Via this short straddle strategy, our trader is speculating on a drop in the underlying NFLX stock price. When we load this trade into the Unusual Whales options profit calculator, we see that the trader would benefit most if NFLX falls to a share price of $350 by the date of expiration. This is because the calls and puts will either expire worthless, or near worthless, allowing the trader to pocket the total premium received.

However, this is not to say the trader needs the stock to trade as low as $350 per share to profit. In the image above, we can see that the straddle our trader opened maintains profitability as long as NFLX is trading below $449.56 (when the call contract price increase offsets the put contract decrease) and above $250.44 (where the put contract increase offsets the call contract price drop).

So, as long as NFLX isn’t trading at a price per share above $449.56 or below $250.44, our trader will still be able to buy back their shorted contracts for a minor profit, or breakeven. Chances are the put contracts he sold will be exercised long before the stock reaches that low of a price, and the trader will be forced to buy NFLX shares for $350/share, so our trader ultimately wants the stock to stay between $350 and $449.56 by expiry.

Thanks for reading! As a reminder, we are having a July 4th sale for 15% off if you want to try out the tools! You can also share or support the Substack for faster podcast updates, or support us which helps us make more free content and tools!

Today’s sponsor is Tradier, the preferred brokerage for options traders.

————

NOTE: This post is not financial advice. The stock market is risky, and any trade or investment is expected to have some, or total, loss. Please do research before any trade. Do not use this information for investment decisions. Check terms on site for full terms. Agree to terms before considering this information.

NOTE: Unusual Whales is not responsible for any promotion. It does not verify the authenticity of the promotion or partnership, nor the merits of the individual promotion. Unusual Whales does not necessarily endorse any one promotion. Please do your own diligence and research before following any one promoted post. Do not consider a promotion of a post an advocation for the sponsor of the post. Do not invest because of any promotion. Do not follow any promotion unless you yourself think it worthwhile. Unusual Whales is not affiliated with any sponsor. Unusual Whales is being paid to promote the promotion. The post itself is an ad, and not a reflection of Unusual Whales itself. Please check full terms for details.