How one SPY trader made 70 million last week, and how to follow Unusual Whales

As part of our weekly and biweekly free educational series

Hey all,

This the Unusual Whales Team, and we are going to spend every Wednesday or Thursday walking you through some trades of the week as well as how to use options tooling. These will be options or equities focused, and be educational in helping you understand a trade and how it made money or why someone would take that trade. We’ll walk through some large trades or unusual trades themselves. Today we are going to follow the large SPY whale, which numerous news organizations followed after we noted it on our twitter (you can see our tweet here)

If you enjoy the content, feel free to support the Substack by subscribing! We will make all educational content (like our free course at unusualwhales.com/course) fully free forever but support does help!

Trader Makes $70 Million by Rolling SPY Calls

Generally, the options chains on ETFs like the S&P 500 ($SPY) are difficult to read. The sheer amount of volume and premiums spent in these options chains muddies the waters, and pinning down directionality with SPY flow is no small feat.

Despite this, sometimes an order on SPY can really stand out. Let’s take a look here at a sizeable order place on May 15, 2023, on the $422 call expiring June 16th.

5/15:

Trader opens 47000 $SPY 422c 6/16 @ 2.69, $12M total

Above, we can see a massive order of 47,000+ volume come in,. Initially, this may not seem especially directional given the 59% “Mid” fill (the blue portion of the bar on the options volume chart). The timing and sizing were definitely unusual, and given context we can speculate the entire position was bought to open. They opened 47,000 contracts at $2.69 for a total of $12 million.

Now we move on to June 6th, when our trader closed this original position and rolled into a new one.

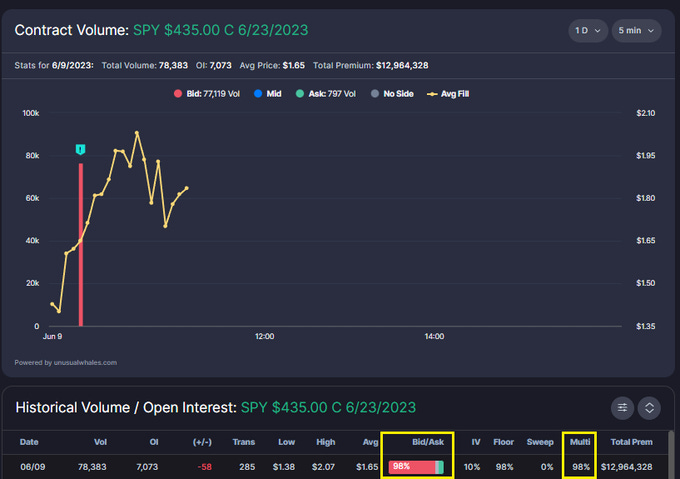

6/9:

Trader closes 47000 $SPY 422c 6/16 @ 9.60 from 2.69, turning $12M to $45M

Trader opens 77000 $SPY 435c 6/23 @ 1.65, making $12M total

In this image, we see another 77,000 volume on the $435 call for June 23rd. At the same exact moment this order came in, we saw the trader close their original position. Although this order seems bid-side, the size of the order relative to the previous position tells us this is likely BTO, not STO. Sometimes large rolling positions can skew the bid/ask. This seems likely to be the case. They sold the original position at $9.60 from an entry of $2.69 for a profit of $33 million; then opened the new position at $1.65 for a total of $12 million premium.

6/14:

Trader closes 77000 $SPY 435c 6/23 @ 4.72 from 1.65, $12M to $36M

Trader opens 38000 $SPY 440c 7/7 @ 4.01, $15M total

Trader opens 38000 $SPY 442c 7/14 @ 4.03, $15M total

Here we see the trader exit the $435c (noted by the drop in OI following the 86,000 volume on 6/14). They took the $435c from an entry of $1.65 to their exit at $4.72, a profit of $24 million.

At this point, you may be thinking, “This trader has already made their bag, surely they’re going on a 3 year sabbatical to the Caribbean!”

Not so fast. At the same moment they closed their $435 position, they rolled yet again. Only this time, they scooped up contracts across two separate expiration dates.

The first leg they rolled their profits into (left) was the $440 call for 7/7/2023. They opened 38,000 contracts at $4.01 for a premium of $15 million.

The second leg (right) was the $442 call for 7/14/2023. They opened 38,000 contracts at $4.03, again for roughly $15 million in premium.

Let’s do a quick recap thus far:

5/15:

Trader opens 47000 $SPY 422c 6/16 @ 2.69, $12M total

6/9:

Trader closes 47000 $SPY 422c 6/16 @ 9.60 from 2.69, $12M to $45M

Trader opens 77000 $SPY 435c 6/23 @ 1.65, $12M total

So far: $33M profit and FREE ROLLING 77000 $SPY 435c 6/23

6/14:

Trader closes 77000 $SPY 435c 6/23 @ 4.72 from 1.65, $12M to $36M

Trader opens 38000 $SPY 440c 7/7 @ 4.01, $15M total

Trader opens 38000 $SPY 442c 7/14 @ 4.03, $15M total

Our trader didn’t stop there, though.

In this image, we see our trader SELL to CLOSE the $440c for 7/7 (left). They opened these for $4.01 per contract, and closed them at $6.66 for a profit of $13 million, literally overnight!

They took their profits and rolled yet again into 38,000 contracts of the $448c for 7/7 at $2.76, for around $10 million in premium. This position is still open, as is the position in the $442c for 7/14.

This trader made $70 MILLION in around a month, with +/- $25 million currently in play on an entirely free trade, given the profits thus far.

This is a pristine example of how rolling contracts with profit can compound your trading gains. Notice how this trader never once sizes with their entire net profit. When they rolled their $33 million gain on 6/9, they entered the new position with the same size they originally started with. This ensures that even if the new position goes to 0, the trader is still able to lock in profits.

Hopefully you found this helpful. We’ll do more breakdowns of trades and the tools of unusual whales biweekly or weekly. The educational content is free but we will have more paid newsletters soon.

We also just recently announced that you can trade on Unusual Whales. Go to our site to get started and get started trading, getting $150 dollars when you open an account free, fully free!