Walking through Chipotle CMG Unusual Trading

Walking through market downturns and equity strength

🛏 JOIN EIGHT SLEEP WITH CODE WHALES FOR $350 OFF! 🛏

Hey all,

Nicholas from the Unusual Whales team, here! We’re going to spend one issue every week walking you through some trades of the week for free to help your trading!

In this issue, we’re going to take a look at a couple of market dip traders who capitalized on the marketwide pullback on February 24th - 25th. We’ll start first with a nice little overnight call contract swing in Chipotle $CMG, then we’ll dive into a put seller on the same contract. This should give a good idea of how different traders play the markets differently!

To start us off here, on February 24th and 25th, equities took a bit of a tumble down. The Invesco QQQ Trust $QQQ ended the regular hours trading session down over one percent, with intraday lows far exceeding that. Chipotle $CMG wasn’t any different, trading as low as $50.55 intraday on the 25th; nearly 5% down from prices seen just a few days prior, and -23% from highs in December 2024. $CMG on the 24th, the date of entry for today’s flow review, was no different, floating around the same lows we see the next day.

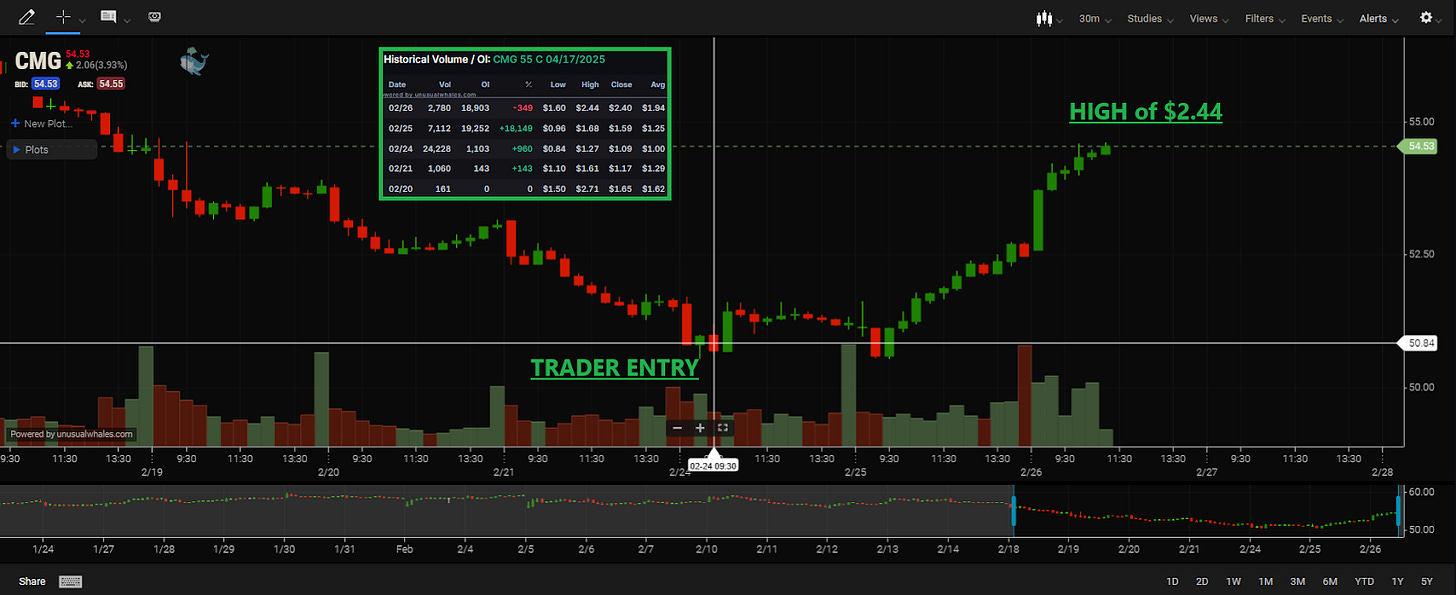

On the morning of February 24th, about an hour after market open, one trader took a stab on the $CMG $55 call contract expiring on April 17th, 2025. Over 13,000 contracts transacted for an average fill price of $0.97 per contract, mostly on the ask side of the bid/ask spread.

Over the course of a few hours, another 5,000 were transacted - also near the ask. By the end of the trading session, over 24,000 total had transacted, against only 1,060 open interest. For this review, we’ll be focusing on those initial 13,000ish contracts.

As the market chugged along on the 24th, $CMG saw a small bounce that took these contracts to a high of $1.27, before pulling back to settle around $1.10 upon market close. On February 25th, $CMG pulled back in the morning again as mentioned above, which brought this position back to breakeven; a price it didn’t stay at for very long.

$CMG reversed off the pullback, and the remainder of the day on February 25th was a story of “upward trend”. From a low of $50.55 per share, the $CMG stock price rose as high as $52.78 per share, dragging the value of the $55C 4/17/2025 right along with it. By market close, the contract hit new highs of $1.68 before settling to close at $1.59 per contract; a 64% gain in just a day. As markets traversed into the February 26th session, it’s pretty clear the trader’s position wasn’t done; and given the fact no sizeable volume closed out, the position remained open.

By mid-morning on February 26th, $CMG traded as high as $54.62 per share, bringing this contract near-the-money. The value of the $55C 4/17/2025 reflected the pop, hitting a high of $2.44 per contract. From their average entry of $0.97, this marked a 151% gain on 13,000 contracts, for a total profit of $1,911,000. That’s nearly $2 million in profit in just a few days!!

Before we get to continue more flow breakdown, I want to tell you about Eight Sleep as it changed the way I sleep for the better.

Numerous neuroscientists like Andrew Huberman have already raved about it, but it goes without saying: my sleep has improved so much with Eight Sleep that even as a whale I cannot tell you how unusual it is. It helps you cool, heat, track and ultimately sleep better. There is no other product like it. Truly.

As a result, I partnered with Eight Sleep to get you guys a discount for a product I love. Head over to www.eightsleep.com/whales/ https://www.eightsleep.com/ca/whales/)and use the code WHALES to get $350 off your very own Pod 4 Ultra, which is customized to your sleep settings. If you sleep better, you'll likely trade better, too!

Join the warm waters at Eight Sleep, and focus on all trader's foundation: their sleep! Join here.

As you may know, long calls aren’t the only way you can trade the upside. Selling puts to open (aka writing, shorting) is another way to play upward stock movement, as you receive a credit for selling what you don’t have, with the hopes of the stock price rising so the value of those puts falls; allowing you to pocket the difference.

It appears that one trader went for this strategy, by opening a put short at around 12:20pm Central time while $CMG traded at $52.09 per share.

2,500 volume on the $55 put contract also expiring on 4/17/2025 at the bid price of $3.90 per contract. The trader received a credit of around $988,000 for writing the puts. Unlike the call buyer, this put write never experienced any drawdown. From their $3.90 entry, the $55p only lost value, albeit slowly at first. By the end of regular market hours, this position was profitable by $23 per contract.

The morning of February 26th, again, $CMG spiked to the upside. From a market open value of $3.31, the contract value rapidly dropped. An hour into the session, the trader was already able to pocket $100 per contract while it traded at $2.86. Within 4 hours of open, the $55P 4/17/2025 hit its low of the day. At $2.55 per contract, this put writer could have pocketed 34.6% of the total credit received, or roughly $342,000!

At the time of writing, both the calls and the puts are likely open, as not enough volume has transacted on either to signal a positional closure.

Thank you as always for reading! REMEMBER!! You can find articles like this and MANY others about Options and the Unusual Whales Platform on the new Information Hub!!

NOTE: This post is not financial advice. The stock market is risky, and any trade or investment is expected to have some, or total, loss. Please do research before any trade. Do not use this information for investment decisions. Check terms on site for full terms. Agree to terms before considering this information.