Understanding Interval Flow and Grouped Options Trades

As part of our free weekly educational series

🍒Get a $50-$5000 bonus when you open a new tastytrade trading account!🍒

Hey all,

This is the Unusual Whales Team, and we are going to spend every Wednesday (or Thursday due to FOMC) walking you through some trades of the week for free to help your trading!

In today’s issue, we’re going to cover how to spot and track a trade using the Interval Flow tool. We’ll also cover the Interval Flow filters that were used in finding this trade, and how you can use other tools to get more information about a transaction.

Interval Flow is another iteration of the Flow Feed where transactions are aggregated into a set time-interval. You can adjust that time frame via the filters here, between 5, 10, and 30 minute intervals. This means that the contracts that appear in the Interval Flow Feed are those who have enough transactions within the selected time interval to meet the criteria you’ve set in your filters.

We’ll start off by going through the filters.

For this Filter, we’re primarily looking for Ask Side transactions with a high chance of opening trades, where the majority of the volume coming in on that contract occurs within a short time frame.

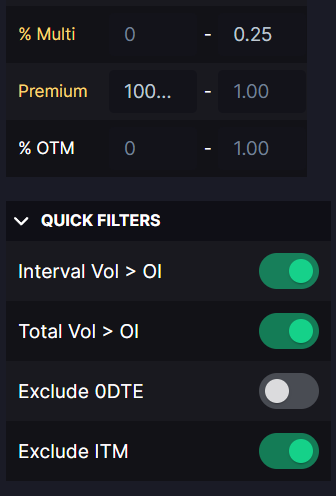

To achieve this, we’ve first set my Interval to 5 minutes. For Equity Type, I’ve removed ETFs and Indices to weed out the noise and hedging mechanisms. We want to see puts AND calls; this filter isn’t for an overall directional bias; we’re looking for individual names and contracts, here. We also want to see flow for all expirations and sectors, so we’ll leave these two blank.

Now we get to the spicy filters; the Interval Activity.

These are the criteria that flow must meet, within the selected time interval, in order to appear in this feed. Now, I mentioned we wanted to see ask side activity where a large portion of the volume occurs within the 5 minute time interval we’ve selected. So the % Total Vol, We’re going to put at .65 to represent 65% of that contract’s volume occurring within this five minute interval.

The Volume is set to a reasonable 500 contracts, for this filter. It’ll still have some noise, but it’ll also help us hit on some lower-volume names with this filter.

For Volume / Open Interest ratio, we always discuss that to be absolutely certain a trade is a new, opening position, that the Size of the trade must be greater than the Open interest. But Other contexts can help you dictate new positions, as well (we’ll touch on this in a bit). So, we don’t want the volume to be BELOW Open interest, but it doesn’t necessarily need to be 2x the open interest for me to be interested in the flow. In this filter, we’ve set this to 1.05 or more, meaning there’s higher volume than open interest, but still can be close.

Like I'd said, we want mostly ask-side, possibly to open trades in this interval feed. So we're going to set Ask % to 0.7 to represent 70% of all the volume on that contract transacting on the ASK side.

For this filter, we’re not really looking for multi-leg transactions, but I don’t want to write off any contracts just because there was some volume involved in multi leg transactions. We’ll keep this range set from 0 to 25% of the volume containing multi-leg trades by setting this field to 0.25.

For Premium, we don’t want to just catch a bunch of one cent contracts with no other context, but we don’t want to miss smaller names, either. we’ll set this to at least $10,000 in premium transacted within the 5 minute time interval.

Now back on the topic of Volume vs. Open Interest. I mentioned we don’t need a crazy ratio for this filter, but we DO want the volume transacted within this five minute interval to be higher than open interest, overall. So I’ve set the slider “Interval Vol > OI”. I’ve also set the Total Vol > OI slider on, and have excluded In the Money contracts that may not give a directional bias due to hedging or arbitrage.

I’ve left the rest of the filters blank.

Before I get started with the trade breakdown, Unusual Whales just partnered with tastytrade to get the biggest deposit bonus possible for all our readers. Get $50-$5000 when you open a new account with tastytrade.

We made it possible so that you can get a huge bonus if you open an account! Get up to $5000 when you open an account, and $50 upfront if you deposit even only $2000! Be on the lookout for more perks for all tastytrade-unusualwhales users coming up!

Back to the trade!

Here is the Interval Flow Feed using these filters from Friday, April 26th, there are a few contracts that caught my eye.

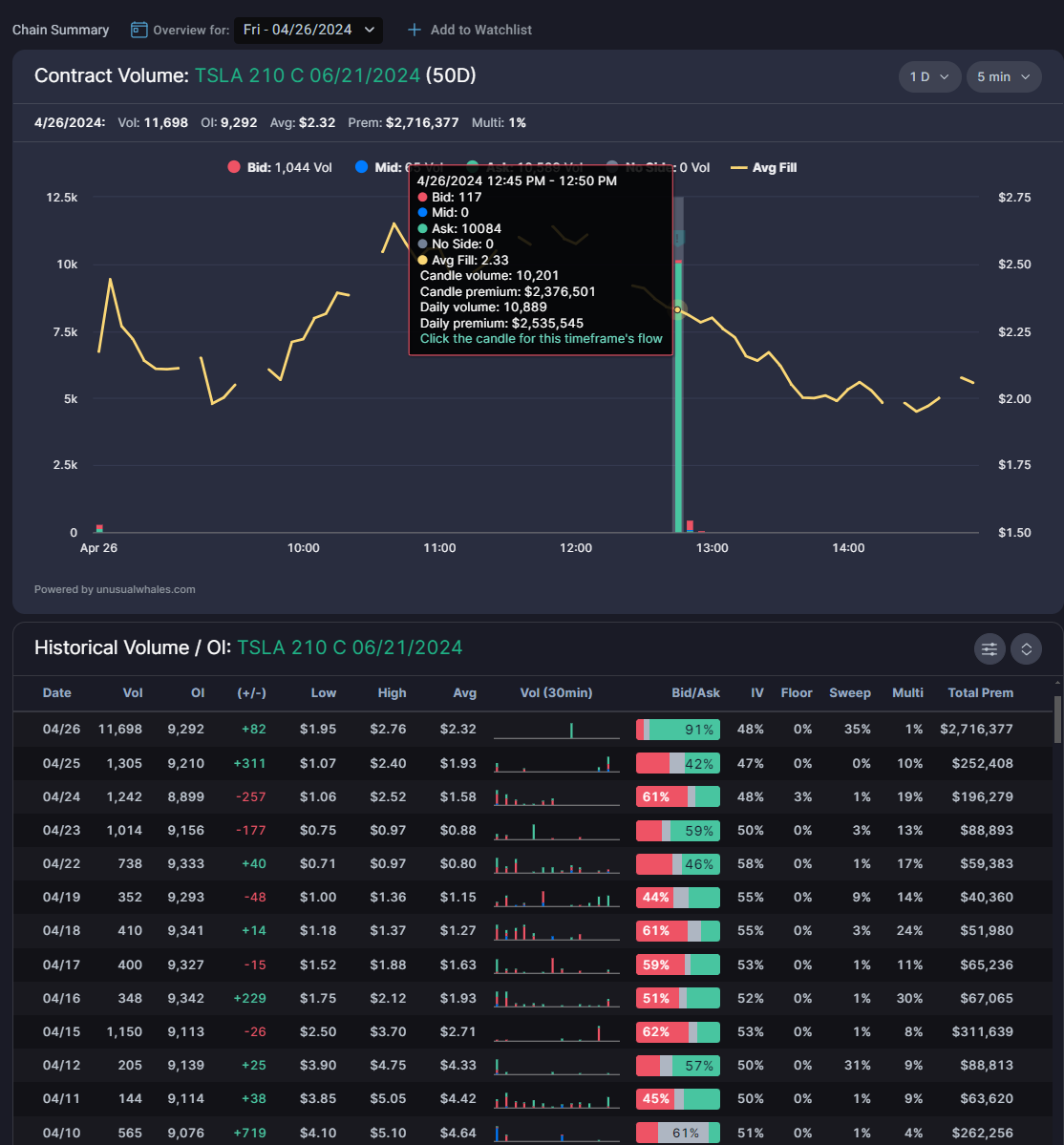

The one we’ll look at is the $TSLA $210C 6/21/2024. While the volume isn’t significantly higher than the Open Interest, the volume that transacted just within that 5 minute time frame was higher than the outstanding contract; 11,698 volume vs,. 9,292 open interest. Not only that, but I knew that $TSLA had been taking a bit of a beating lately, and many were betting on a rebound.

Clicking into the Chain Summary for the contract, we can see fairly clearly that nearly all of the volume transacted came within that 5 minute time frame, and almost all of it transacted ask side.

So, let’s click on that volume candle for 5 minute interval between 12:45 and 12:50PM central. Doing so automatically takes you to the Flow Feed with the filters set to that exact time frame, on that exact contract.

In the feed here, we can clearly see the repeated ask-side orders on the contract filling at $2.33 to $2.34 per contract. The transactions also triggered a Repeated Hits alert followed by two large orders. Although none of these trades had a SIZE greater than OPEN INTEREST, the total volume transacted in that time interval quickly overtook the Open Interest; we can hypothesize that this is a new position due to the nature of the fills. It’s not a GUARANTEE that all were opening trades, but it does seem much more likely than position closures.

To help us out with that, we can look at the Historical Flow for the contract. Here, we can see that positions have been building over quite a long time, with open interest rising on both bid-side and ask-side transactions. So it seems, due to how that Open Interest came to be, that the volume observed on April 26th is not related to the outstanding Open Interest. This raises the likelihood that the April 26 volume was new positioning.

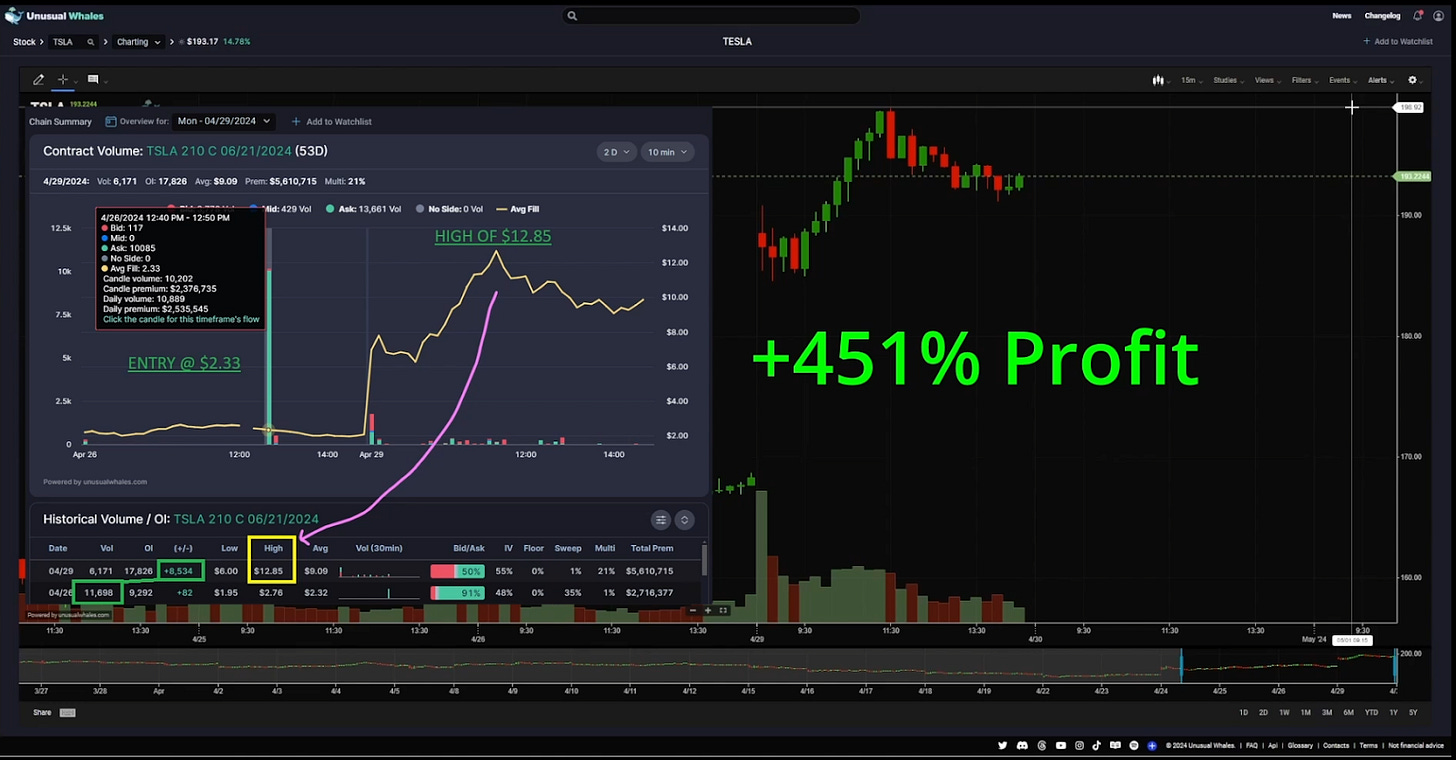

On April 29th, $TSLA did indeed rally.

Of the 11,698 volume transacted on Friday, 8,534 carried over into open interest; that’s a hard confirmation of new positions opening. In the case of this contract, however, waiting for confirmation on this one would have missed the move. On the morning of April 29th, $TSLA had already gapped from around $170/share to $190 per share. At that point, we can see the contracts already hit handsome profitability. Over the course of the morning, $TSLA continued to rally, reaching as high as $198 per share. At the high of day, this position had gone from their original entry of $2.33 per contract, to a high of $12.85 per contract; a 451% gain.

Thank you as always for reading! I hope this article helps you understand how to speculate on options flow that suggests an intraday trade! Be on the lookout for more guides, walkthroughs, and Education on the Unusual Whales YouTube channel!

And remember; you can get a $50-$5000 bonus when you sign up with tastytrade and fund your account!🍒

NOTE: This post is not financial advice. The stock market is risky, and any trade or investment is expected to have some, or total, loss. Please do research before any trade. Do not use this information for investment decisions. Check terms on site for full terms. Agree to terms before considering this information.