Understanding Gamma, GEX, and Gamma impact on options using Unusual Whales

As part of our free weekly educational series

🍒Get a $50-$5000 bonus when you open an tastytrade x UW account🍒

Hey all,

This is the Unusual Whales Team, and we are going to spend every Wednesday walking you through some trades of the week for free to help your trading!

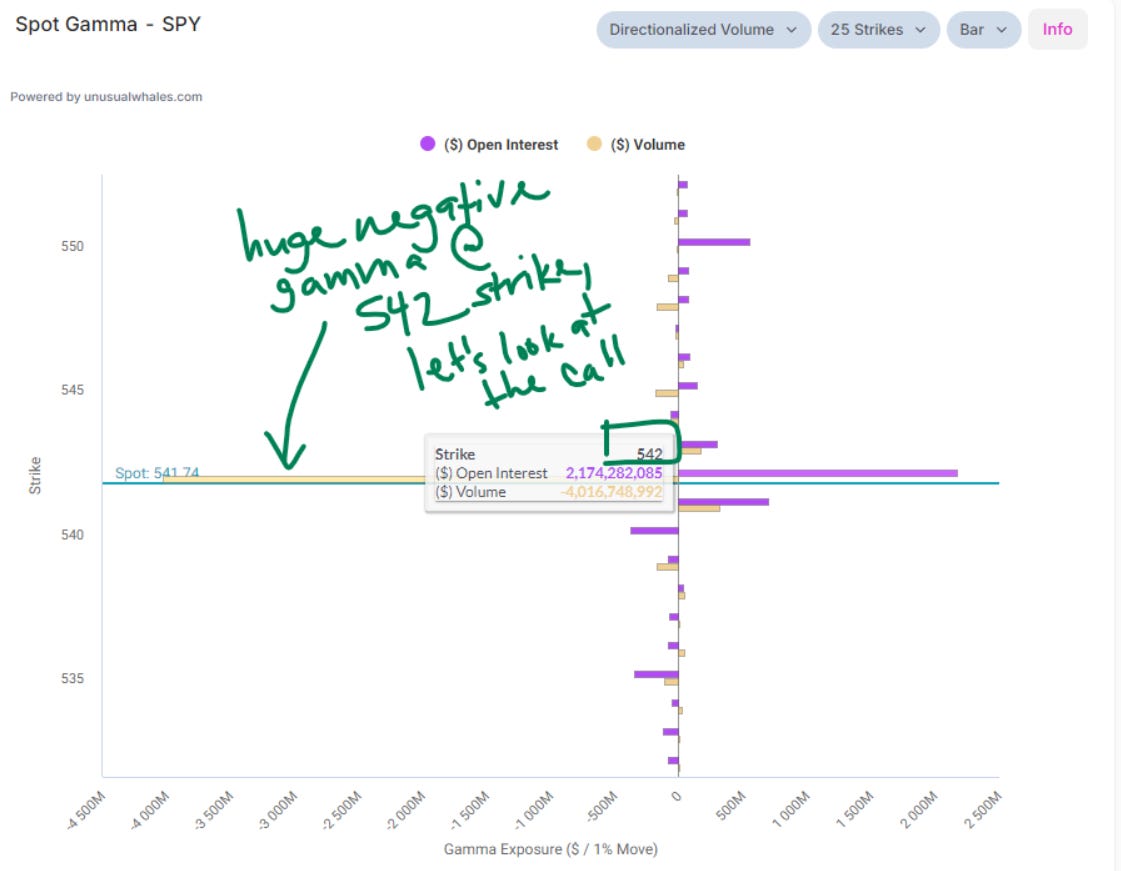

In today’s issue, we’re going to cover some explanations of gamma impact utilizing the Directionalized Volume Spot Gamma feature on Unusual Whales. We’ll cover these concepts using the S&P 500 ETF Trust, $SPY.

To demonstrate Gamma impact, we’ll look into the $542 $SPY strike from August 13, 2024.

At the end of the day on August 13th, we observed a significant negative gamma bar at the $542 strike in $SPY. This was puzzling, especially since $SPY had embarked on an absolute ripper of a rally throughout the day. We noted significant activity at the $542 strike, starting with the Calls. Given that it was a trend up day, it was logical to anticipate a high 0DTE volume there. It’s important to remember that gamma is a short-term phenomenon, and short-dated options generally hold the highest gamma values.

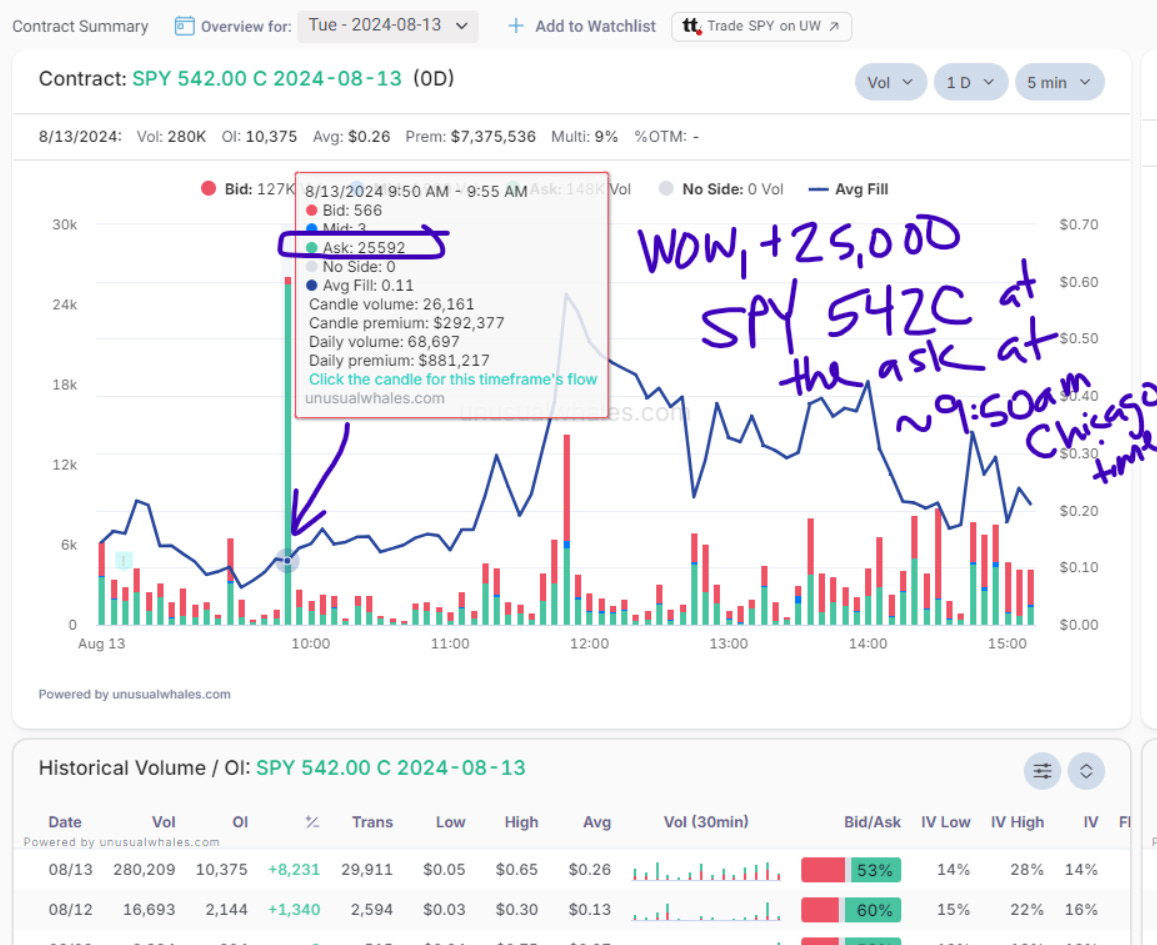

For further inspection, we jump over to the options chains page for $SPY to examine the 0DTE $542 call contract that expired on August 13th. Selecting the bars next to the strike, we can view the intraday data for the strike.

Immediately, we can see a massive volume spike of ask-side transactions on the $542C, totaling over 25,000 contracts around 10:50 ET. The average fill on the contracts was $0.11. The cheap value of the contracts on an instrument as large and liquid as $SPY tells us that, at the time of fill, this contract was quite a ways out of the money. So, even though this was a fairly large amount of volume, its distance from the spot price resulted in a relatively small directional gamma impact. To verify, we click the volume bar in question.

After clicking the volume bar, we’re taken to the Flow page with filters pre-set to the time interval we clicked on, and our assumption proves correct. The trade’s directional gamma is fairly small. Let’s bust out the ‘ole calculator and do a little math here to show it.

For the sake of easy math, let’s round this interval of transactions down to a size of 25,000 contracts. To determine the total gamma, we take the size (25,000) times 100 (the amount of shares each contract represents), and multiply that again, by the contract’s gamma (0.0589). 25000 x 100 x 0.0589 = $147,250. This means that the impact of this single trade on the entire $SPY option complex is a relatively small $147,250 per 1% move in the underlying. So like we mentioned earlier– the position size is quite large, but the gamma impact was relatively small.

Before we get to the latter half of the $542C gamma impact, Unusual Whales has partnered with Tema ETFs and their $HRTS ETF, the GLP-1 ETF for the earnings of Eli Lilly, $LLY, & Novo Nordisk, $NOVO.

Novo Nordisk, $NOVO, earnings reported:

- Net profit: 20.05 billion Danish kroner ($2.93 billion), est: $20.9 Danish kroner

- Raised 2024 outlook, sales growth 19% / 27%

Eli Lilly, $LLY, earnings reported:

- Revenue: $11.30 billion

- Raised revenue guidance by $3 billion; EPS increased 68% to $3.28 on a reported basis

The actively managed Tema GLP-1, Obesity and Cardiometabolic ETF aims to generate long-term capital growth via investment in GLP-1 and weight loss companies combating obesity and cardiometabolic diseases. Tema notes that obesity is on the cusp of a therapeutics revolution, while the leading cause of death, heart disease, witnesses a renaissance of therapies, driven by genetic insights and tools. Tema aims to utilize their team’s investment and scientific expertise to navigate the regulatory and financing risks of this secular theme.

Check them out! And back to Gamma:

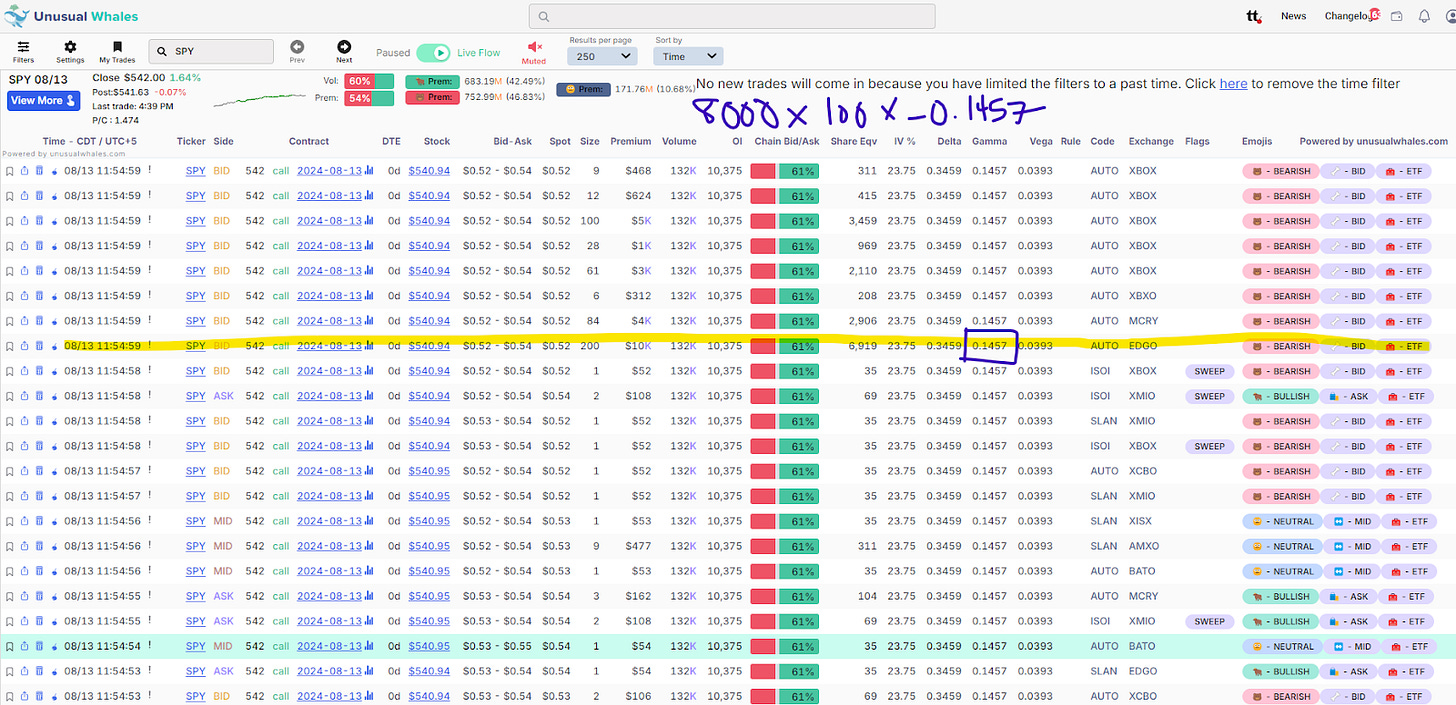

Throughout the day, the markets rallied with force. The underlying price in $SPY rose from $538.32 to end the regular hours trading session above a spot price of $542. At around 1:00pm ET, we noted a sizable bid-side order of 8,000 $SPY $542C contracts.

Let’s assume this was our initial trader, Mr. 25K, closing part of their position. Since the underlying spot price now sat much closer to the strike of this contract ($541.15), the contract’s gamma was much higher than when the position was opened. Gamma on the $542C had risen from 0.0589 to 0.1457; a nearly 150% increase in the contract’s gamma. Due to this, the 8,000 volume bid-side transaction resulted in a significantly more dramatic gamma effect.

Let’s math it out again to demonstrate:

8,000 x 100 x -0.1457 = -$799,999.85 per 1% move

Now remember, earlier we saw the order of 25,000 contracts and noted the positive gamma response was quite small, despite the massive volume of contracts. So even though this bid-side transaction of 8,000 contracts was merely 32% the size of the ask-side order, the negative gamma impact was much much higher, because the underlying stock price was now so much closer to the strike of $542. As the day continued, the gamma value on $542 strike $SPY contracts kept growing, since both Calls and Puts were both so close to the money. This means that as $542 strike transactions kept firing closer and closer to the end of the cash session, especially those super-profitable $542Cs that were closing, the $542 strike spot gamma bar would keep getting more and more negative.

We won’t try to replicate all the math associated with this effect (since we would technically need to gather all of the $542 strike Call and Put trades from all expirations to get the total reached at end of day), but seeing how a small positive gamma impact early in the session can grow into a large negative gamma impact later in the session hopefully helps clear up the counterintuitive “market up, spot gamma negative” bar on the chart.

Thank you as always for reading! Be on the lookout for more guides, walkthroughs, and Education on the Unusual Whales YouTube channel!

Don’t forget to check out our sponsor, Tema’s GLP-1 Obesity and Cardiometabolic ETF, ticker $HRTS!

NOTE: This post is not financial advice. The stock market is risky, and any trade or investment is expected to have some, or total, loss. Please do research before any trade. Do not use this information for investment decisions. Check terms on site for full terms. Agree to terms before considering this information.

NOTE: Unusual Whales is not responsible for any promotion. It does not verify the authenticity of the promotion or partnership, nor the merits of the individual promotion. Unusual Whales does not necessarily endorse any one promotion. Please do your own diligence and research before following any one promoted post. Do not consider a promotion of a post an advocation for the sponsor of the post. Do not invest because of any promotion. Do not follow any promotion unless you yourself think it worthwhile. Unusual Whales is not affiliated with any sponsor. Unusual Whales is being paid to promote the promotion. The post itself is an ad, and not a reflection of Unusual Whales itself. Please check full terms for details.