Understanding Dividend Arbitrage Strategies and Unusual Whales Independence Sale

A breakdown of a complex call strategy and how to use Unusual Whales to spot it

🍒Open an account with our partner tastytrade for a UW bonus 🍒

Hey all,

Nicholas from the Unusual Whales team, here! We’re going to spend one issue every week walking you through some trades of the week for free to help your trading!

In this issue, we’re going to cover a commonly-noticed, but rarely discussed, phenomenon in options flow that leaves many flow traders confused, or unnecessarily excited. This type of strategy (dividend arbitrage) occurs in both puts and calls, and in this article we’re going to cover Call Option Dividend Arbitrage.

BEFORE we get started, Unusual Whales is having an Independence Day sale! Get 15% off any tier, or 20% off for upgrading your current tier! You can get the sale HERE before it expires: unusualwhales.com/settings

Call Option Dividend Arbitrage

A type of options activity that you may see often is ‘dividend arbitrage’. This is an advanced trade that has no directional bias to it that seeks to take advantage of the market mechanics behind dividend payouts. This will be as simple of an overview as I can come up with, given the general complexity of this activity.

When it takes place

The trade itself will take place on an equity that trades ex-dividend the following session.

For example: if $AAPL's ex-dividend date is Wednesday, January 10, then the dividend trade would take place on Tuesday, January 9.

If $AAPL's ex-dividend date is Monday, January 10, then the dividend trade would take place on the previous Friday, January 7.

What it looks like

A trader will open a deep ITM call debit spread on an equity that trades ex-dividend the following session. This call debit spread can be opened as a multileg trade or be legged into via two single-leg trades. Here's a look at a bunch of $AVGO call transactions from June 18th (market closed June 19 for holiday, ex-dividend date June 20th:

In this instance, the call spreads are being legged into, given that this entire page of activity consists of single-leg activity.

Note that the strike prices are deep in the money and that the total premiums transacted can be in the millions and tens of millions. It bears repeating: this activity has no directional bias. Given the volume and premiums, however, dividend call activity can set off different types of volume/activity scanners that traders may have. Case in point: $AVGO saw 3.5x more options volume than the 30-day average.

Here's another look, this time on $RTX back from 2024. In this case, the entire page consists of multileg activity, indicating that the spreads were not legged into but rather opened outright. Again: note that the strike prices are in the money and that the total premiums (and volumes) are quite high.

What actually happens

A trader opens a long call spread on a stock that trades ex-div the following session (two traders will often link up to act as the counterparty to the other's action—see the hypothetical example). Once the trader has opened the spread, the long call is exercised, which results in a position of being long stock while having a short call position.

Options assignment is completely random, so there is no guarantee that an exercise will result in the respective number of shares. The traders using this strategy may profit from being short the in-exercise calls if the holders of the long call positions do not exercise. On the ex-dividend date, if the traders are assigned on less than their full short call position, they may profit as the calls lose value when the share price falls, while their loss in the long stock position is exactly offset by the receipt of the dividend.

Here is a look at the updated open interest values on some of the $AVGO contracts that were exercised:

The open interest has dropped off significantly, given all of the arbitrageurs competing with each other for the available open interest. Certain options exchanges actually incentivize this type of activity by offering it to their customers for reduced fees, which is effectively the only way in which this trade can be profitable.

Before we get to examples, Unusual Whales has a MASSIVE announcement!

OpenBB’s Discord AND Telegram Bots are now part of the Unusual Whales Pod!

We're excited to announce that the OpenBB Discord and Telegram Bot is now part of the Unusual Whales ecosystem! Enjoy your favorite functionalities and data through new and extended commands as well as new functionalities like Market Tide and Netflow, now integrated within the Unusual Whales platform.

Check out the full news, and how to add the Premium Discord Bot to your server, in this announcement article: https://unusualwhales.com/openbb-announcement

Simple Hypothetical Example

Market Maker Jack buys a call spread from Market Maker Jill, who in turn buys a call spread from Market Maker Jack on the day prior to ex-div.

Jack and Jill both exercise their long calls.

Now only short the call sales from the call spreads (and long stock from the exercised calls), the traders hope that the OCC assignment process results in them receiving assignments on less than their entire positions.

If this happens, they will remain short some calls and long XYZ shares, on which they will receive the dividend. Remaining options exposure can be hedged by buying inexpensive puts to leg into the “conversion” side of a reversal/conversion trade.

The large volume of the trade served to crowd out the original natural short call open interest and effectively transferred most of the profitable short call, long stock position to the two traders.

Advanced Hypothetical Example

Here is a simplified example that takes place on the sessions prior to the ex-dividend date: Stock XYZ is trading at $50 and will pay a dividend of $0.10 per share.

In this simplified example, let's assume that the market makers have agreed to use the dividend trade strategy in the $40 calls for stock XYZ.

Open interest in the $40 calls (at the beginning of the trading day) is 10,000.

Transactions:

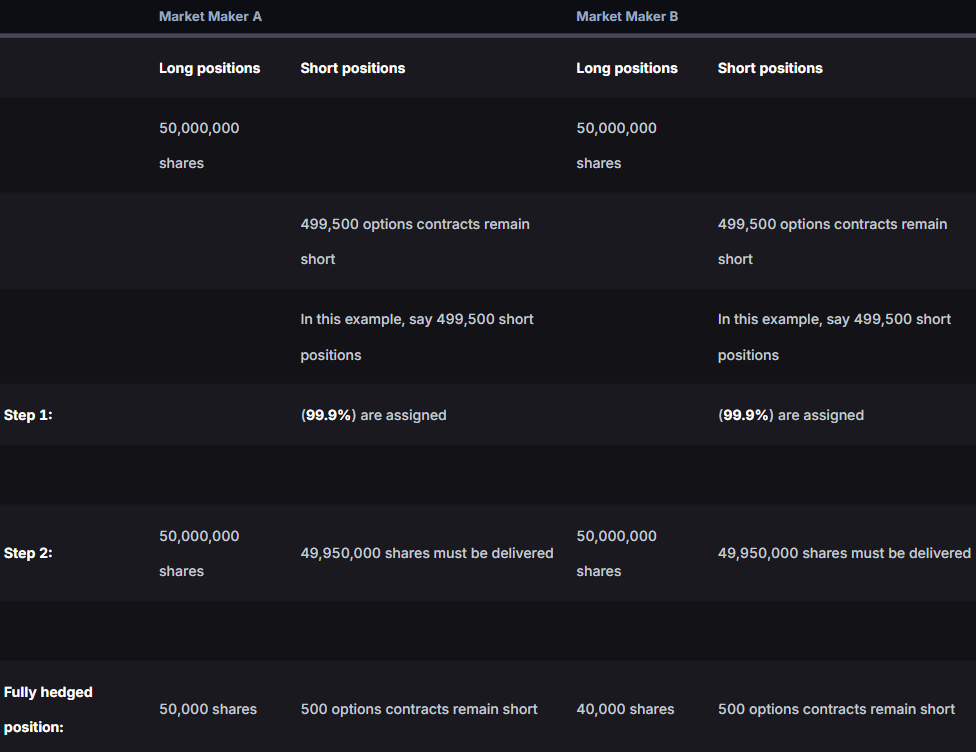

Market Makers A and B trade the $40 calls back and forth with one another. At the end of the day, they end up with the following positions in the $40 calls:

Exercise Process

• In this example say 90% of market participants in the original open interest pool exercise their call options. Because open interest was originally 10,000 contracts this means that 9,000 contracts remain unexercised.

• Market Makers A and B exercise all of their long the stock, meaning they are now long the stock.

Assignment Process

• 1,009,000 call options have been exercised out of a total of 1,010,000 that were outstanding.

• OCC now randomly selects investors who hold short positions to close the stock for each call option that has been exercised.

• An investor who is short the position has a 99.9% chance of being assigned to deliver the stock (1,009,000 call options exercised/1,010,000 open short positions).

• That same investor also has a 0.1% chance of remaining short (1,000 unexercised call options/1,010,000 open short positions).

At the end of the day…

• Market Maker A has exercised 500,000 call options, but must turn around and deliver against 99.9% of his 500,000 short call positions (499,500 call options). Market Maker A retains a balance of 500 short call options. He holds stock for 500 of the long call options he exercised and ends up with 50,000 shares of Stock XYZ (1 option contract = 100 underlying shares). He collects a dividend of $0.10 on each of these shares, or $5,000 total.

• Market Maker B has exercised 500,000 call options, but must turn around and deliver against 99.9% of his 500,000 short call positions (499,500 call options). Market Maker B retains a balance of 500 short call options. He holds stock for 500 of the long call options he exercised and ends up with 40,000 shares of Stock XYZ. He collects a dividend of $0.10 on each of these shares, or $4,000 total.

• Both market makers have collected the dividend payments associated with those shares, and both remain fully hedged with short deep-in-the-money calls. This means they can trade out of their hedged position but will wait until expiration if it is near after they collect the dividend.

TLDR

Dividend arbitrage is a complex strategy that cannot be replicated by retail traders. The best a retail trader can do is understand them for what they are, and be able to identify them.

REMEMBER!!!! Unusual Whales is having an Independence Day sale! Get 15% off any tier, or 20% off for upgrading your current tier! Check out the full sale here, and get it before it goes (this is our best sale of the summer: unusualwhales.com/settings)

Thank you as always for reading! REMEMBER!! You can find articles like this and MANY others about Options and the Unusual Whales Platform on the new Information Hub!!

NOTE: This post is not financial advice. The stock market is risky, and any trade or investment is expected to have some, or total, loss. Please do research before any trade. Do not use this information for investment decisions. Check terms on site for full terms. Agree to terms before considering this information.