Spirit Airlines Merger and the Unusual Flow Beforehand

As part of our free weekly educational series

Hey all,

This is the Unusual Whales Team, and we are going to spend every Wednesday walking you through some trades of the week for free to help your trading!

These educational tutorials will be options or equities focused to help you understand why or how interesting and useful trades were made, and how to utilize and read the various tools on Unusual Whales.

In today’s issue, we’re going to go over some flow on two names that had news-driven movement. Both of these trades interestingly enough came in just days before news dropped on the respective names, held into the news release and over a 3-day market weekend (markets were closed Monday 1/15 in observance of Martin Luther King, Jr. day), and exited for handsome profits. We’ll start off here with Spirit Airlines, Inc. $SAVE.

On Friday, 1/12 while the $SAVE stock price traded at $14.95 per share, we noted a flurry of unusual options flow for the at-the-money $15P 01/26/2024 contract. Implied Volatility for the contract sat around 276%, an indication of a sizable implied move. At the time, rival company JetBlue Airways $JBLU was in talks to acquire Spirit Airlines.

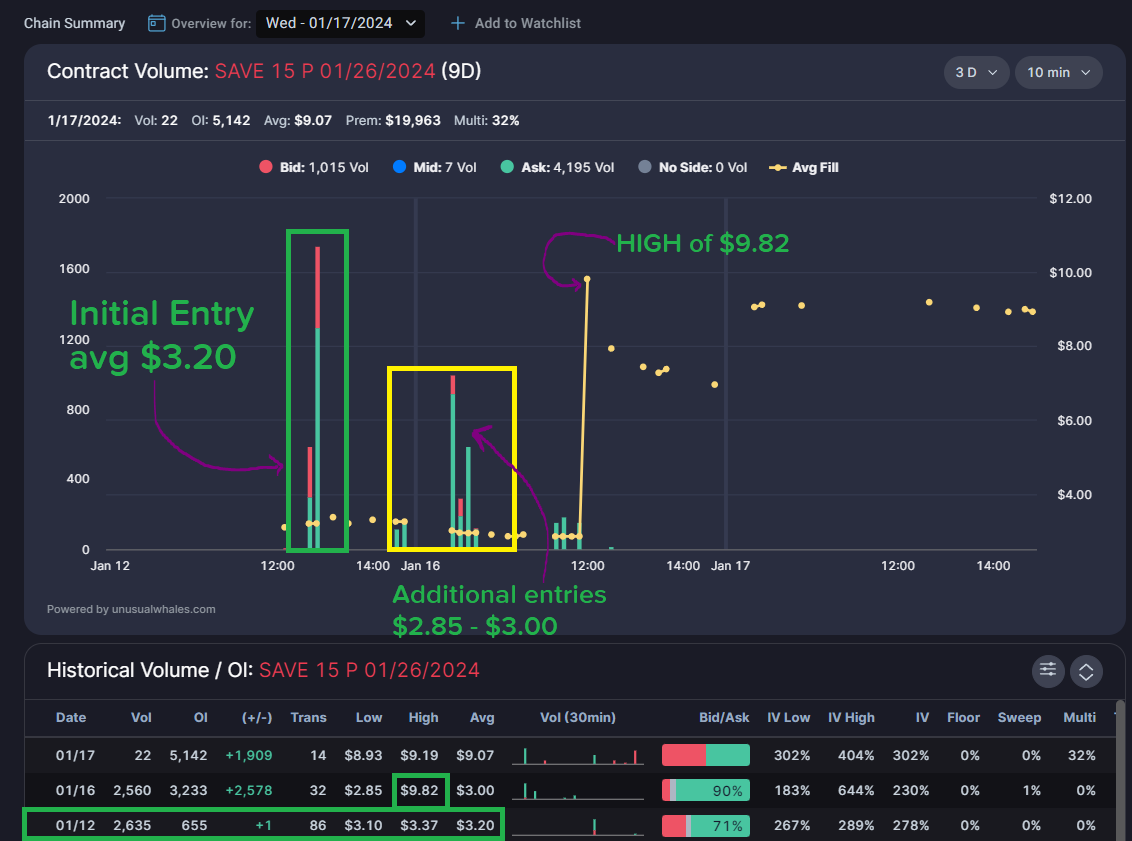

Initially, the strike saw volume ramp up around 12:50pm CST, then another small wave of volume hit the flow later that afternoon, totaling just under 3,000 volume for the day. The initial entry was for 2,320 contracts at an average price of $3.20 per contract. Another flurry of orders came in the late afternoon of Friday, 1/12 bringing the daily total volume to 2,636, as well as the morning of Tuesday, 1/16, for prices ranging from $2.85 to $3.00 totaling an additional 2,000+ contracts. A few hours after the Tuesday morning flow is where things got interesting.

Around noon CST on Tuesday, 1/16, it was reported that a judge blocked the $3.8 billion merger between Jet Blue and Spirit Airlines was in violation of antitrust laws. The judge indicated that the merger would stifle competition, and raise air fares for consumers. Although the companies disagreed with the ruling, the damage was done. $SAVE stock price dropped by a factor of 50% in value instantly, from $15.24 to $6.59 per share.

Above we can see the result of this trade. On the left, we have our initial entry of $3.20 per contract, followed by our slightly lower-cost entries. That big spike in the contract value marks the instant the news dropped about the blocked merger. The value of the contract jumped instantaneously from $2.85 per contract to an astounding $9.82 per contact. Taking into account the $3.20 fills from Friday, the average cost per contract was roughly $3.03, marking this trade a 225% gain basically overnight.

Before we get into the next trade, please take a moment to check out today’s sponsor and #ad, Cybeats! (OTC: CYBCF)

Cybeats is a rapidly expanding cybersecurity company focused on software security solutions. It offers a Software as a Service (SaaS) product named "SBOM Studio," which scans software for vulnerabilities and threats, facilitates regulatory compliance by sharing SBOMs with government agencies, and provides a centralized tool for managing cyber risk. Cybeats has been providing services to U.S. infrastructure and Fortune 500 companies. The company is attempting to be positioned as a crucial player in the growing market for software safety and compliance, with the SBOM market expected to grow substantially.

The next trade we’ll take a look at also occurred on Friday 1/12; this time in the cannabis ETF, AdvisorShares Pure US Cannabis ETF, $MSOS.

Another example of an unusually timed trade comes from U.S. Cannabis ETF $MSOS. On Friday 1/12, we caught unusual options activity on the $9C 1/19/2024. Over the course of the day, over 12,000 volume transacted, almost entirely at the ask, ranging from fills of $0.21 to $0.31 for an average fill of $0.26 per contract. Granted, the open interest on the chain was around 11,000 but open interest Tuesday morning confirmed new positioning.

For decades, cannabis advocates and activists have been pressuring the U.S. Government to decriminalize and legalize cannabis. Politicians, Health and Human Services, and citizens alike have also been pressuring the DEA to at a minimum adjust the drug classification of cannabis from Schedule I (the class for substances with no currently accepted medical use and a high potential for abuse) to Schedule III (drugs with a moderate to low potential for physical and psychological dependence).

The night of Friday, 1/12, the US Food and Drug Administration released documents that reflect the HHS evaluation of scientific and medical evidence supporting the reclassification of cannabis to Schedule III. $MSOS, an ETF whose future relies on the shifting social landscape surrounding cannabis in the United States, responded in kind to the FDA’s blessing.

On the morning of Tuesday 1/16, $MSOS jumped as high as $8.85 per share on the FDA news. This brought our trader’s contracts from that $0.26 average to $0.87 per contract; a 234% gain effectively overnight. Judging by the open interest and volume on 1/16, much of this position is likely still open; but a 234% gain after holding over a long weekend is certainly nothing to scoff at.

Occasionally we’ll see examples like this, where flow will hit the tape and news will follow. Sometimes, trades can get very lucky. Other times, the opposite happens. But in the cases of $MSOS and $SAVE this week, the timing of the flow in relation to the subsequent news is certainly an eyebrow raiser.

So, what do you think? Is the timing of these trades in relation to news lucky?

Or Unusual?

https://twitter.com/unusual_whales/status/1746322754578878690

MSOS

https://twitter.com/unusual_whales/status/1747330115242262788

SAVE

To clear up some of the terminology used in this article that you may not be familiar with, there are numerous educational resources on Options Basics, Misconceptions, Greeks, and Finding and Tracking Flow over on the Unusual Whales Education page!

As a reminder: our sponsor today is Cybeats! (OTC: CYBCF)

Thank you as always for reading! I hope you find these types of articles helpful in your journey to learning how to read and interpret the flow and all the tools therein!

NOTE: This post is not financial advice. The stock market is risky, and any trade or investment is expected to have some, or total, loss. Please do research before any trade. Do not use this information for investment decisions. Check terms on site for full terms. Agree to terms before considering this information. Unusual Whales was paid by Cybeats to host this newsletter via a third party called Outside the Box.

NOTE: Unusual Whales is not responsible for any promotion. It does not verify the authenticity of the promotion or partnership, nor the merits of the individual promotion. Unusual Whales does not necessarily endorse any one promotion. Please do your own diligence and research before following any one promoted post. Do not consider a promotion of a post an advocation for the sponsor of the post. Do not invest because of any promotion. Do not follow any promotion unless you yourself think it worthwhile. Unusual Whales is not affiliated with any sponsor. Unusual Whales is being paid to promote the promotion. The post itself is an ad, and not a reflection of Unusual Whales itself. Please check full terms for details.