Rates Paused at FOMC, UW Christmas Sale, Nike Earnings, and Three Rate Cuts in 2024

Everything happening in the markets in three minutes or less

Good Evening!

The Federal Reserve on Wednesday, marking the final meeting of the year, continued its pause of interest rates, as of expected.

Before we get into it know that Unusual Whales is having a Christmas/Holiday Sale for the holidays!! Get 15% off all tiers, and 20% off when you upgrade your account! This is the one of the best sales of the season so click here to check it out.

Also, as a small note for the holidays, you can also gift a membership for Unusual Whales for anyone who wants to learn options, US equities, try our courses, or more. Go to the gift page to gift UW this holiday season!

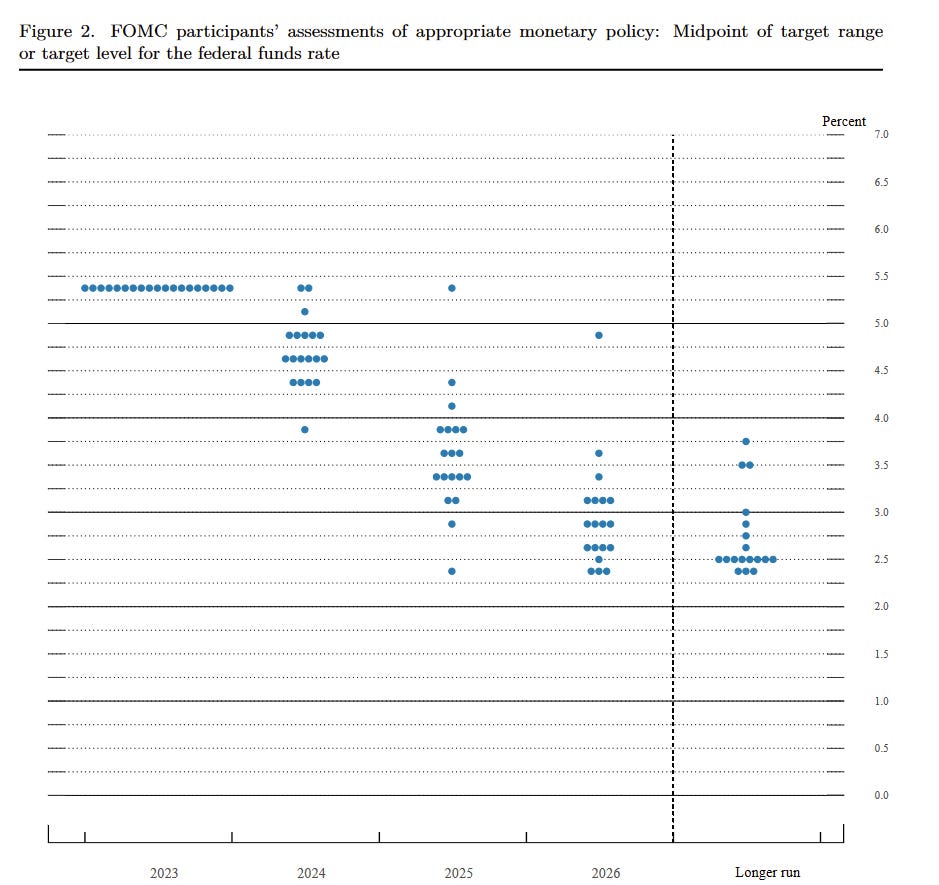

Back to the market, one part of this FOMC meeting came as a surprise to many investors, and it was the expected interest rates for 2024 given the dot plots.

What does this show? As seen through the dot plot above, it seems as if rate cuts are ahead in 2024, with median estimates of interest rates dropping by 50 basis points. Jerome Powell’s speech also revealed dovish sentiment, with him expressing that current policy is “well into restrictive territory”, along with stating that the FOMC has been discussing rate hikes.

As for events this week, earnings are mostly quiet, with some names such as FedEx, Nike, and Micron expected to report earnings.

Last Week’s Markets

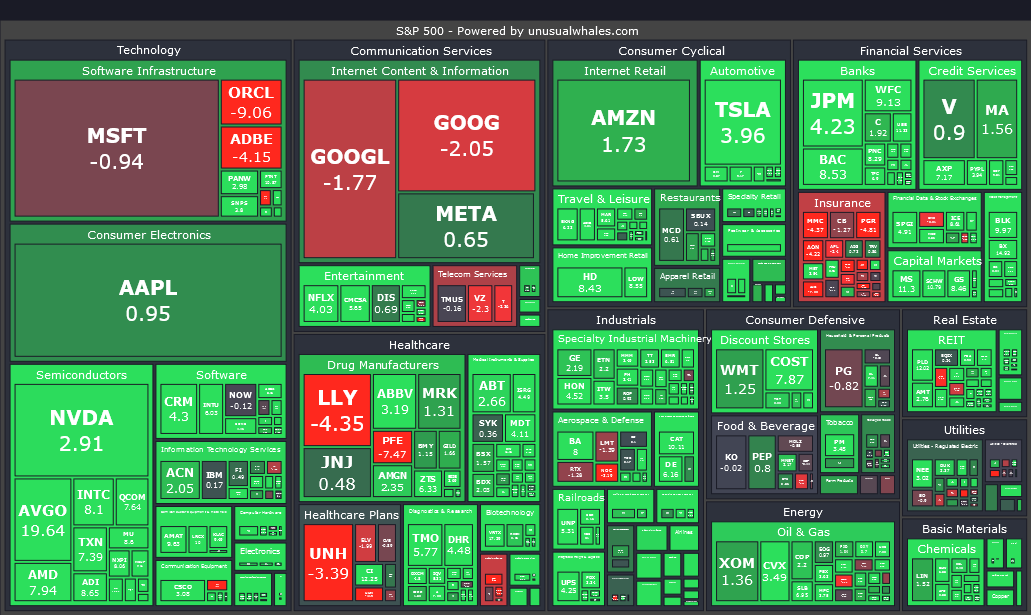

Markets continue their stretch of gains, marking the seventh continuous week without a decline. The markets rallied heavily after FOMC.

Semiconductors led gains last week following analyst upgrades over gaining artificial intelligence excitement, with Broadcom surging over 17% in the week alone. The S&P 500 surged 2.74% in the last week, the Dow Jones Industrial Average gained 2.90%, and the NASDAQ was up 3.30% for the week.

During FOMC, we held a space regarding the rate pause as it happened live, and what it meant for the market. You can find those here:

Spotify:

Apple:

Notable Upcoming Earnings

Monday

HEI (afterhours) Implied Move: +/- 5.28% Sector: Industrials

Tuesday

FDS (premarket) Implied Move: +/- 4.96% Sector: Financial Services

FDX (afterhours) Implied Move: +/- 4.42% Sector: Industrials

Wednesday

GIS (premarket) Implied Move: +/- 4.01% Sector: Consumer Defensive

MU (afterhours) Implied Move: +/- 4.73% Sector: Technology

Thursday

CCL (premarket) Implied Move: +/- 7.08% Sector: Consumer Cyclical

KMX (premarket) Implied Move: +/- 7.68% Sector: Consumer Cyclical

CTAS (premarket) Implied Move: +/- 4.57% Sector: Industrials

NKE (afterhours) Implied Move: +/- 5.18% Sector: Consumer Cyclical

News of the Week

Millennials are now flocking back to NYC (Read more)

38% of Europeans say they are no longer able to have three meals a day regularly (Read more)

Ukraine could lose war with Russia if U.S delays military aid (Read more)

California likely to see $68 billion deficit next fiscal year (Read more)

Federal Reserve to continue to pause rates (Read more)

Elon Musk planning to start a university (Read more)

U.S consumers are spending at record levels (Read more)

Restaurant prices are up 24% since 2020 (Read more)

Bill Gates says generative AI has plateaued (Read more)

Fed signals 3 interest rate cuts for next year (Read more)

Retail investors are buying the most stock since 2022 (Read more)

U.S Economic Events

Monday

10:00 am Home builder confidence index

Tuesday

8:30 am Housing starts

8:30 am Building permits

Wednesday

8:30 am U.S. current account

10:00 am Existing home sales

Thursday

8:30 am Initial jobless claims

8:30 am GDP (revision)

8:30 am Philadelphia Fed manufacturing survey

10:00 am U.S. leading economic indicators

Friday

8:30 am Durable-goods orders

8:30 am Durable-goods minus transportation

8:30 am Personal income

8:30 am Personal spending

8:30 am PCE index

8:30 am Core PCE index

8:30 am PCE (year-over-year)

8:30 am Core PCE (year-over-year)

10:00 am New home sales

10:00 am Consumer sentiment (final)

Have a great week everyone!Once again, we hope you enjoy the upcoming holiday season with your families and friends! Checkout out the Christmas sale that ends in a few days if you are interested in trying out our tools or supporting our software!