Option Trading while SPY, SPX, and QQQ all reach ATHs

As part of our free weekly educational tutorial

Hey all,

This is the Unusual Whales Team, and we are going to spend every Wednesday walking you through some trades of the week for free to help your trading!

These educational tutorials will be options or equities focused to help you understand why or how interesting and useful trades were made, and how to utilize and read the various tools on Unusual Whales.

But first, we announced our Portfolios feature on Sunday, that allows you to invest in members of Congress alongside their portfolio, as well as people like Jim Cramer and David Portnoy! Come join it today by clicking here!

Options Traders Take Advantage of the Market Rally and All time highs

In today’s issue, we’re going to take a look at an unusual options trade that capitalized on the upward movement in the markets. As $SPX and $QQQ continue to tag new all-time highs, traders have taken advantage of this sentiment with options trades, and in some cases rolled their contracts in an attempt to take off another bite of the uptrend.

Let’s start here with options activity spotted on the SPDR S&P 500 ETF Trust, $SPY.

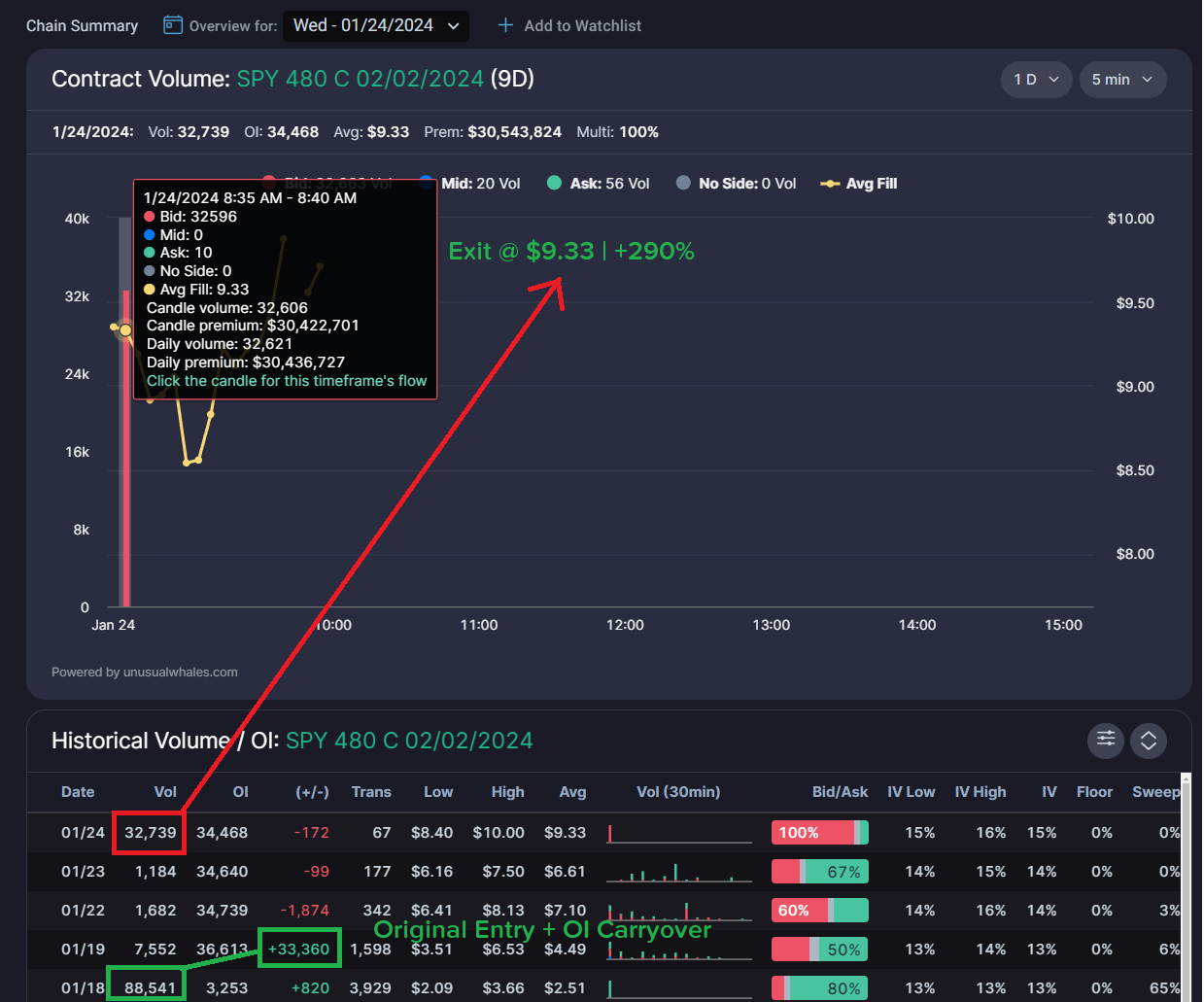

On January 18th, 2024 at 08:46am CST, we noted repeat action on the $SPY $480C 2/2/2024. Throughout the day, over 88,000 contracts transacted; however we’ll be focusing on around 33,000 contracts here. While $SPY traded at $473.79, those roughly 33,000 contracts transacted at the ask, for an average fill of $2.42 per contract, and a total premium of roughly $7,986,000.

The market continued its upward trajectory over the following days, bringing these contracts to new highs each day. On 1/19, the contracts reached a high of $6.53; on 1/22, they hit $8.13 per contract. On January 23rd, the market experienced a small pullback, bringing this contract down as low as $6.61 per contract, but the trader held onto their position. On 1/24, the trader must have hit their profitability goal, because we noted evidence of an exit on the position (but not just an exit; we’ll get to that shortly).

On the morning of 1/24, while $SPY traded at $487.57 (putting the $480C $7.57 in the money), flow nearly the exact same size as the original entry hit the tape at the bid, transacting at $9.33 per contract. Given the nature of this at-bid flow, speculation is that the trader exited their position (OI will confirm, but this seems highly likely as-is). Our trader made a 290% return on their position, for a profit of roughly $22.5 million. Remember I mentioned the trader didn’t stop there? When this $480 contract closed, it was paired with another contract in a multi-leg transaction.

Before we get to the new $SPY positioning, please take a moment to check out today’s Sponsor, Masterworks! #ad

Warren Buffett vs Banksy: The surprising winner

What’s one market not on Warren Buffett’s radar that grew at an annualized rate of 14.4% from 2007 to June 2023, outpacing shares of his very own Berkshire Hathaway? The market for Banksy’s art.

That's right, Banksy. And now, for the first time, everyday investors are getting in on the action. Thanks to Masterworks, the award-winning platform for investing in blue-chip art.

Masterworks enables anyone to invest in shares of paintings by artists like Banksy, Basquiat, and Picasso. With 20 exits, investors have already realized returns of 16.0%, 21.5%, 35% and more.

Now, Unusual Whales readers can skip the waitlist to join with this exclusive link.

Investing involves risk and past performance is not indicative of future returns. See important Reg A disclosures and aggregate advisory performance masterworks.com/cd

Now let’s roll back into the $SPY roll.

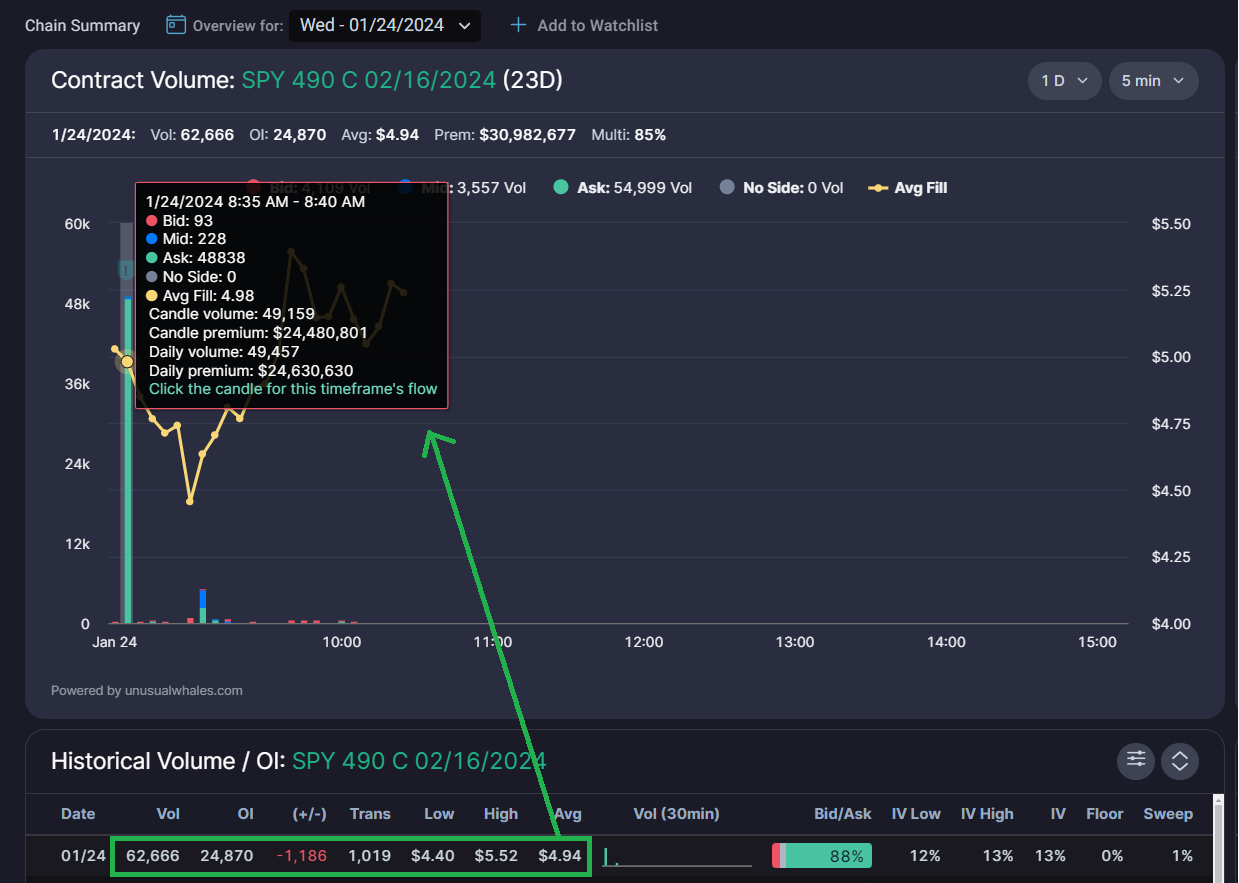

Upon their exit of the $480C for profit, our trader took those profits and rolled them into the $490C 2/16/2024 contract. 48,942 of the $490C traded in this multi leg transaction at the ask for an average fill of $4.94 per contract, and a total premium of around $24 million.

Remember our trader profited roughly $23 million on the $480C from a $7.68 million buy-in; so in this case, our trader has not technically profited on their initial trade, as they rolled the entirety of their profits into this new position.

At the time of writing, the $490C traded as high as $5.52 per contract, meaning our trader is profitable on this new position. There’s no evidence as of this publication of any exit from this position, so we’ll monitor it more as we move forward!

Let’s recap:

$SPY $480C 2/2/2024 | $2.42 → $9.33 | +290%

→ rolled profits into ←

$SPY $490C 2/16/2024 | $4.94 → $5.52 | +12% (unrealized)

Given our trader rolled their position, while this new position is still open they have not technically pocketed any of their profit yet. However, as things stand given the $480C trade and this new $490C position, the trader is roughly $2.8 million in profit on the new position, and $25 million overall.

To clear up some of the terminology used in this article that you may not be familiar with, there are numerous educational resources on Options Basics, Misconceptions, Greeks, and Finding and Tracking Flow over on the Unusual Whales Education page! Also checkout our Portfolios feature to follow any member of Congress’s portfolio as they trade.

As a reminder: our sponsor today is Masterworks! Click the link to skip the waitlist!

Thank you as always for reading! I hope you find these types of articles helpful in your journey to learning how to read and interpret the flow and all the tools therein!

NOTE: This post is not financial advice. The stock market is risky, and any trade or investment is expected to have some, or total, loss. Please do research before any trade. Do not use this information for investment decisions. Check terms on site for full terms. Agree to terms before considering this information.

NOTE: Unusual Whales is not responsible for any promotion. It does not verify the authenticity of the promotion or partnership, nor the merits of the individual promotion. Unusual Whales does not necessarily endorse any one promotion. Please do your own diligence and research before following any one promoted post. Do not consider a promotion of a post an advocation for the sponsor of the post. Do not invest because of any promotion. Do not follow any promotion unless you yourself think it worthwhile. Unusual Whales is not affiliated with any sponsor. Unusual Whales is being paid to promote the promotion. The post itself is an ad, and not a reflection of Unusual Whales itself. Please check full terms for details.