Nvidia NVDA earnings breakdown, COST and other earnings/economic events for week, Memorial Day Sale ENDS ON WEDNESDAY

Everything you need to know about the markets in three minutes or less

🍒Get a $50-$5000 bonus when you open an tastytrade x UW account🍒

Hi there!

Let’s see what is upcoming in the markets this upcoming week, and what happened this week quickly before the week begins! We’ll break down NVDA’s earnings as well as option strategies related to the company.

Before we begin, Unusual Whales is running a Memorial Day Sale which ENDS ON WEDNESDAY!

Get 15% off any Flow or Portfolio plan, and an additional 5% off when you upgrade to a higher tier. Offer ends May 28th. Sign up here: unusualwhales.com/settings

Also, a quick heads-up: API prices are increasing on Thursday, May 29th!

If you're already subscribed, your current rate is locked in. But if you've been thinking about trying the API, now’s the time to do it before the new rates kick in!!

See updated pricing here: https://unusualwhales.com/public-api#pricing

Looking at last week’s markets, the markets fell all week, down 1.53% for the week after Trump declared 50% tariffs on the EU and market news. Here is what that looked like in the heatmaps:

Before we look at all earnings, let’s break down NVDA, Nvidia earnings, which you can see a breakdown on Unusual Whales at unusualwhales.com/stock/NVDA/earnings.

To start off, NVDA NVDA earnings are not easily predictable, but the market has done a good job of predicting earnings. Nvidia has beat their EPS and had positives financials annually on average, with improving margins. Let’s get into it!

Generally over the last 12 quarters, NVDA rises into the days before earnings, then rallies after the initial move a few days later, generally up +10% in 21 days after earnings. However, right now it is up a up +20.52% (!!!!) two days into its earnings (on average it is only 8% higher right before earnings).

Over the last 11 quarters, NVDA has large implied moves, with this move being smaller than previous moves. The moves themselves have not been within the expected move bands 5 of the last 11 times, meaning that generally NVDA earnings are not well defined by market makers. NVDA has only fallen below its expected move once over the last twelve earnings, generally hitting above. NVDA has surprised mainly to the upside, and is mostly at the upper band of its expected move, so longing the stock has been a great play into earnings (with an average move of 8% from earnings). As such, on the call and put side selling straddles has been profitable, but longing with equities has outperformed as well. At the moment, the Implied Move (expected move) for NVDIDA is at 6.64% or $8.71 in dollar terms. This is it’s smallest move over the last 7 quarters.

How would straddles have performed if you took them? Because NVDA has had well defined expected moves, generally, the one week short straddle has performed poorly only 6 of the last 123times (buying direction has worked, however via equities, so watch your deltas). Yet the one day short straddle performs actually better than the one week straddle, as Nvidia likes to rally post earnings. As such, if you do sell premium, better take gains right away after earnings and IV crush. The 1d short straddle actually worked 9 of the last 13 times. If you are looking to sell for premium here be very careful and pick wide strikes, lean bullish.

If you are buying direction, generally up has worked in the long term, but NVDA has had volatile earnings (to the upside) so be careful with your wings, a broken butterfly might be effective here. Ratio spreads might work here, or selling diagonals might be a good idea! Generally, because volatility is lower than normal, be careful of larger moves not priced in.

Here is an example call debit spread, which leans bullish but makes your calls slightly cheaper. IV crush would destroy these, and better to sell puts if you are leaning bullish, which you can find below. Here’s the call debit spread: https://unusualwhales.com/options-profit-calculator/call_debit_spread/NVDA/-NVDA250606C00134000,NVDA250606C00128000

Bullish sell puts: https://unusualwhales.com/options-profit-calculator/short_put/NVDA/-NVDA250606P00131000

You can see more option strategies at Unusual Whales and our options profit calculator by clicking here.

Walmart’s earnings have a full breakdown on Unusual Whales at https://unusualwhales.com/stock/NVDA/earnings.

Below you can see all company earnings at https://unusualwhales.com/earnings?formats=table&order=report_date&order_direction=asc&min_options_vol=500

Monday, May 26

EHANG HOLDINGS (EH) reports before the open with an expected move of $1.72. EPS is estimated at N/A. Stock volume is 2.59 million, and options volume is 19,000 contracts.

Tuesday, May 27

OKTA (OKTA) reports after the close with an expected move of $12.78. EPS is estimated at $0.24. Stock volume is 1.93 million, and options volume is 11,000 contracts.

PDD HOLDINGS (PDD) reports before the open with an expected move of $8.20. EPS is estimated at $2.25. Stock volume is 7.59 million, and options volume is 98,000 contracts.

Wednesday, May 28

C3AI (AI) reports after the close with an expected move of $2.71. EPS is estimated at $-0.67. Stock volume is 4.02 million, and options volume is 73,000 contracts.

SALESFORCE (CRM) reports after the close with an expected move of $19.49. EPS is estimated at $1.87. Stock volume is 8.89 million, and options volume is 41,000 contracts.

ELF BEAUTY (ELF) reports after the close with an expected move of $9.90. EPS is estimated at $0.57. Stock volume is 2.98 million, and options volume is 14,000 contracts.

HP (HPQ) reports after the close with an expected move of $1.65. EPS is estimated at $0.80. Stock volume is 7.66 million, and options volume is 11,000 contracts.

NVIDIA (NVDA) reports after the close with an expected move of $8.71. EPS is estimated at $0.80. Stock volume is 198.82 million, and options volume is 3.09 million contracts.

PURE STORAGE (PSTG) reports after the close with an expected move of $7.22. EPS is estimated at $-0.04. Stock volume is 2.77 million, and options volume is 5,000 contracts.

ABERCROMBIE & FITCH (ANF) reports before the open with an expected move of $8.86. EPS is estimated at $1.36. Stock volume is 1.89 million, and options volume is 11,000 contracts.

DICK'S SPORTING GOODS (DKS) reports before the open with an expected move of $10.66. EPS is estimated at $3.37. Stock volume is 1.84 million, and options volume is 12,000 contracts.

MACY'S (M) reports before the open with an expected move of $0.98. EPS is estimated at $0.14. Stock volume is 6.9 million, and options volume is 14,000 contracts.

Before we break down more earnings, Unusual Whales is running a Memorial Day Sale which ENDS ON WEDNESDAY!

Get 15% off any Flow or Portfolio plan, and an additional 5% off when you upgrade to a higher tier. Offer ends May 28th. Sign up here: unusualwhales.com/settings

Also, a quick heads-up: API prices are increasing on Thursday, May 29th!

If you're already subscribed, your current rate is locked in. But if you've been thinking about trying the API, now’s the time to do it before the new rates kick in!!

See updated pricing here: https://unusualwhales.com/public-api#pricing. Alright, back to earnings.

Thursday, May 29

AMERICAN EAGLE OUTFITTERS (AEO) reports after the close with an expected move of $0.94. EPS is estimated at $-0.25. Stock volume is 6.03 million, and options volume is 27,000 contracts.

COSTCO WHOLESALE (COST) reports after the close with an expected move of $34.16. EPS is estimated at $4.25. Stock volume is 1.41 million, and options volume is 30,000 contracts.

DELL TECHNOLOGIES (DELL) reports after the close with an expected move of $8.97. EPS is estimated at $1.50. Stock volume is 3.92 million, and options volume is 35,000 contracts.

GAP (GAP) reports after the close with an expected move of $3.10. EPS is estimated at $0.44. Stock volume is 13.0 million, and options volume is 8,000 contracts.

MARVELL TECHNOLOGY (MRVL) reports after the close with an expected move of $6.16. EPS is estimated at $0.44. Stock volume is 17.44 million, and options volume is 61,000 contracts.

UIPATH (PATH) reports after the close with an expected move of $1.39. EPS is estimated at $-0.05. Stock volume is 9.26 million, and options volume is 22,000 contracts.

ZSCALER (ZS) reports after the close with an expected move of $16.57. EPS is estimated at $-0.03. Stock volume is 2.0 million, and options volume is 21,000 contracts.

BATH & BODY WORKS (BBWI) reports before the open with an expected move of $2.25. EPS is estimated at $0.47. Stock volume is 4.25 million, and options volume is 13,000 contracts.

BEST BUY CO (BBY) reports before the open with an expected move of $5.22. EPS is estimated at $1.09. Stock volume is 3.59 million, and options volume is 13,000 contracts.

FOOT LOCKER (FL) reports before the open with an expected move of $0.43. EPS is estimated at $-0.07. Stock volume is 5.51 million, and options volume is 17,000 contracts.

KOHLS (KSS) reports before the open with an expected move of $0.99. EPS is estimated at $-0.22. Stock volume is 7.78 million, and options volume is 22,000 contracts.

LI AUTO (LI) reports before the open with an expected move of $2.28. EPS is estimated at N/A. Stock volume is 2.31 million, and options volume is 6,000 contracts.

Friday, May 30

CANOPY GROWTH (CGC) reports before the open with an expected move of $0.33. EPS is estimated at $-0.10. Stock volume is 8.15 million, and options volume is 8,000 contracts.

UP FINTECH HOLDING (TIGR) reports before the open with an expected move of $0.60. EPS is estimated at N/A. Stock volume is 1.81 million, and options volume is 17,000 contracts.

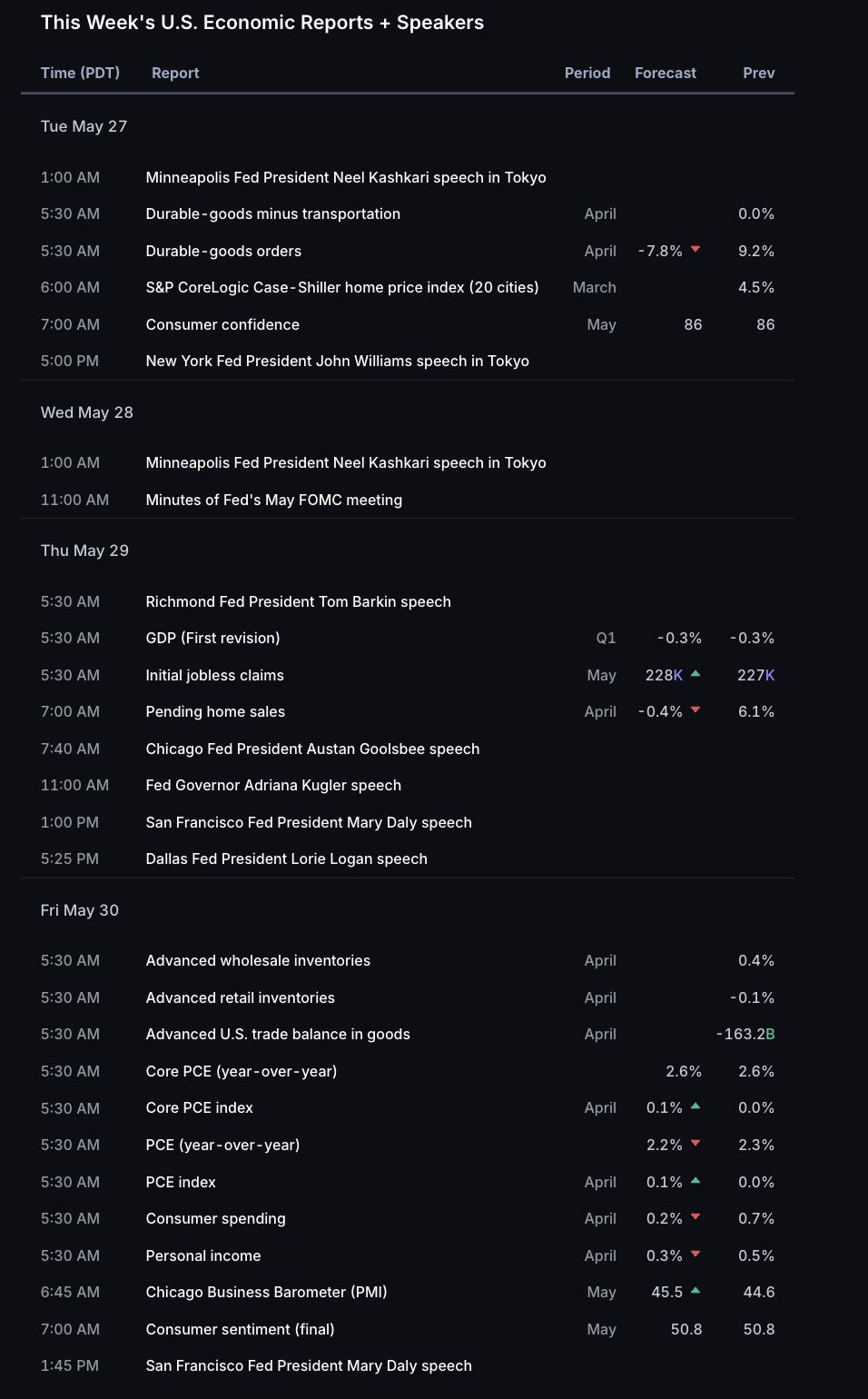

Here are the economic events for the week (reminder, we added a Trump calendar seen here: https://unusualwhales.com/trump-tracker)

Here is the economic calendar this week. More at unusualwhales.com/economic-calendar:

Tuesday, May 27

1:00 AM PDT – Minneapolis Fed President Neel Kashkari speaks in Tokyo

5:30 AM PDT –

Durable Goods Orders (April): Forecast -7.8%, Previous 9.2%

Durable Goods ex-Transportation: Forecast 0.0%

6:00 AM PDT – S&P CoreLogic Case-Shiller Home Price Index (March)

Tracks home prices across 20 major cities; previous: 4.5% YoY increase.7:00 AM PDT – Consumer Confidence (May)

Forecast and previous: 865:00 PM PDT – New York Fed President John Williams speaks in Tokyo

Wednesday, May 28

1:00 AM PDT – Neel Kashkari speaks again in Tokyo

11:00 AM PDT – FOMC Minutes (May Meeting)

Will provide insight into the Fed’s policy debate and future rate outlook.

Thursday, May 29

5:30 AM PDT –

Richmond Fed President Tom Barkin speaks

GDP (Q1, First Revision): Forecast -0.3%, Previous -0.3%

Initial Jobless Claims: Forecast 228K, Previous 227K

7:00 AM PDT – Pending Home Sales (April)

Forecast -0.4%, Previous 6.1%7:40 AM PDT – Chicago Fed President Austan Goolsbee speaks

11:00 AM PDT – Fed Governor Adriana Kugler speaks

1:00 PM PDT – San Francisco Fed President Mary Daly speaks

5:25 PM PDT – Dallas Fed President Lorie Logan speaks

Friday, May 30

5:30 AM PDT –

Advanced Wholesale Inventories (April)

Advanced Retail Inventories (April)

Advanced U.S. Trade Balance in Goods (April): Previous -163.2B

Core PCE Price Index (April): Forecast 0.1%, Previous 0.0%

Core PCE YoY: Forecast and Previous 2.6%

PCE Price Index (April): Forecast 0.1%, Previous 0.0%

PCE YoY: Forecast 2.2%, Previous 2.3%

Consumer Spending (April): Forecast 0.2%, Previous 0.7%

Personal Income (April): Forecast 0.3%, Previous 0.5%

6:45 AM PDT – Chicago PMI (May): Forecast 45.5, Previous 44.6

7:00 AM PDT – Consumer Sentiment (Final, May): Unchanged at 50.8

1:45 PM PDT – Mary Daly speaks again

And remember!!! Until May 28th, get 15% off any Flow or Portfolio plan, and an additional 5% off when you upgrade to a higher tier. SALE ENDS ON WEDNESDAY.

If you want to try out the API, now’s your chance before prices increase on May 28th! Check pricing and tiers here: https://unusualwhales.com/public-api#pricing

Thank you as always for reading and have a great week!