Nancy Pelosi bought new option positions in VST, TEM, AMZN, and GOOGL. Here's how to track them in REAL TIME using Unusual Whales

As part of our free weekly educational series.

🍒Get a $50-$5000 bonus when you open an tastytrade x UW account🍒

Hey all,

Nicholas from the Unusual Whales team, here! We’re going to spend one issue every week walking you through some trades of the week for free to help your trading!

Believe it or not…. Politicians are trading again. In this issue, we’re going to break down some of Nancy Pelosi’s four newest option trades in $AMZN, $GOOGL, $TEM, and $VST; one of which saw significant profit almost instantaneously and is currently sitting at a gain of +111%!!

The Unusual Whales Portfolios feature is the only place you can catch and track politicians’ trades in real time.

Now, let’s see what she opened.

We’ll start off light here, and build up to the big one. The first new transaction Nancy made that we’ll be looking at is the Google $GOOGL $150 Call contract expiring on 1/16/2026. On Tuesday January 14th, 50 contracts of the $150C 1/16/2026 hit the tape, a mix of bid and ask side transactions. At the time of fill, $GOOGL traded at $188.97 per share, marking these contracts 21% in the money. The total premium Nancy spent on this position came to $314,432. Open interest carried over into the 1/15 trading day, confirming this new position, alongside her trade report. At the time of writing, Nancy’s $GOOGL position is up +14%, for a monetary gain of just under $36,000.

The next position came in the form of Amazon $AMZN $150 call options also expiring in January of 2025. Once again on January 14th, 50 contracts hit the tape, this time clearly on the ask-side of the bid-ask spread.

Like the $GOOGL position, the $AMZN $150C had high open interest, but the report and open interest carryover confirmed this as a new position. At the time of fill, $AMZN traded at $216.74 per share, placing this $150C roughly 31% in the money. At the time of writing, Nancy’s $AMZN calls are sitting at a gain of +19%, or $1,508 per contract, for a dollar gain of over $75,000.

Next, we have another January 16, 2026 contract, this time on Vistra $VST. Nancy generally transacts in the money contracts, and this $VST position is deep in the money, indeed. She opened 50 contracts of the $50 call on January 14th when $VST was trading at $168.87 per share. That means she opened a position in a contract that was 70% in the money.

These $VST $50 calls are also handsomely profitable. At the time of writing, $VST is trading at $188.57 per share – $20 and nearly 12% higher than her entry. The contract value also reflects this, sitting at a profit of +17%, a monetary gain of $2,007 per contract, for a total gain of $100,350.

Before we get to the final and most RAPIDLY profitable transaction Nancy recently reported, did you know that you can trade options DIRECTLY from the Unusual Whales platform?

Well, Unusual Whales has partnered with tastytrade to provide the best experience for you as a trader. Get the best platform for trading options and US equities, and get a huge exclusive signup bonus when you use our link.

We made it possible so that you can get a huge bonus if you open an account! Get up to $5000 when you open an account, and $50 upfront if you deposit even only $2000! Be on the lookout for more perks for all tastytrade-unusualwhales users coming up!

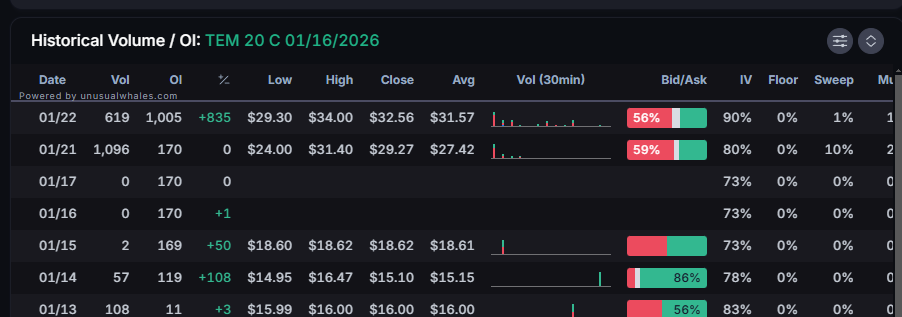

Now, as I mentioned, one of the four newly reported transactions really went on a tear almost immediately after Nancy Pelosi’s purchase dropped. On January 14th, Nancy reported a new position on the $TEM $20 call contract expiring on January 16, 2025.

Here in the flow, we see her orders hitting the tape; 50 contracts near the ask within a wide bid-ask spread. These contracts filled for an average price of $15.08 per contract, while $TEM stock traded at $31.73 per share.

Well, you don’t have to be a professional chartist to know what I’m going to say next. Within days, the $TEM stock price experienced an absolute explosion. Over night, the stock gapped up into market open on 1/15 to hit a high of $37.63 per share. In just one day, Nancy’s new position in those $50 calls had already profited $354 per contract. But as you can see above, $TEM didn’t stop there.

Over the next few days, $TEM’s stock price continued to rise, and news of Nancy’s position had spread from Unusual Whales to other media outlets. On 1/21, someone (or someone(s)), opened 835 volume on the contract, but the highs just went higher.

At the time of writing, $TEM has hit a local high of $52.91 per share, and is currently trading at $50.46. That’s a $21.18 gain in the stock, or +66%, in just a handful of days. Nancy’s options are even more impressive, now up an astounding 111% in just a week, hitting a contract high of $34.00. This means that from Nancy’s entry of $15.08, she’s now up 111%, for a gain of $1,892 per contract, and $94,600 overall.

Now, let’s summarize:

$GOOGL $150C 01/16/2026 | +14% | +$36,000

$AMZN $150C 01/16/2026 | +19% | +$75,000

$VST $50C 01/16/2026 | +17% | +$100,350

$TEM $20C 01/16/2026 | +111% | +$94,600

Since filling these new positions on January 14th, Nancy Pelosi is already up a grand total of $307,750 in just a week.

REMEMBER! Unusual Whales has partnered with Tastytrade to offer on-site trading directly from your Flow Feed! Sign up here!

From Guides on the Platform to General Options Education, the Unusual Whales Information Hub has you covered. What else would you like to see?

Thank you as always for reading! REMEMBER!! You can find articles like this and MANY others about Options and the Unusual Whales Platform on the new Information Hub!!

NOTE: This post is not financial advice. The stock market is risky, and any trade or investment is expected to have some, or total, loss. Please do research before any trade. Do not use this information for investment decisions. Check terms on site for full terms. Agree to terms before considering this information.