Markets for the week, NFLX earnings breakdown, and economic events

Everything you need to know about the markets this week in three minutes or less.

🍒Get a $50-$5000 bonus when you open an tastytrade x UW account🍒

Hi there!

Let’s see what is upcoming in the markets this upcoming week, and what happened this week quickly before the week begins!

Looking at last week’s markets, the markets rallied into the new Trump presidency, up nearly 1% for the week. Here is what that looked like in the heatmaps:

It should be stated that the markets are closed tomorrow due to the holiday for Martin Luther King day.

Here are the upcoming earnings this week, including the expected moves, EPS mean estimates, and notable details. See more at unusualwhales.com/earnings.

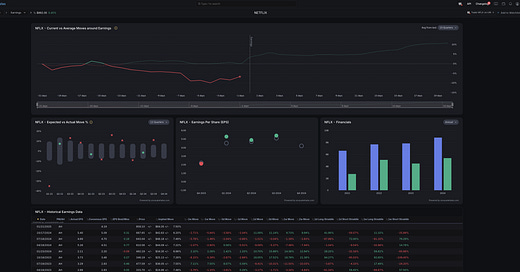

Let’s break down Netflix, NFLX earnings, which you can see a breakdown on Unusual Whales at https://unusualwhales.com/stock/NFLX/earnings.

To start off, Netflix NFLX earnings are relatively predictable. NFLX beats their EPS and financials on average. Let’s get into it

Generally over the last 12 quarters, NFLX rises into the days before earnings, and then rallies after the initial move a few days later, generally up +10% in 21 days after earnings. However, right now it is up a down 6% into earnings.

Over the last 11 quarters, NFLX has large implied moves, but has its biggest implied move over the last 6 quarters this earnings. The moves themselves have not been within the expected move bands 8 of the last 11 times, meaning that generally NFLX’s earnings are wildly not well defined, and but generally surprises to the upside, normally. As such, on the call and put side selling straddles has been very unprofitable, with but selling puts and holding a week out generally an okay strategy for NFLX (longing with equities has outperformed, generally besides Q1 2022). At the moment, the Implied Move (expected move) for NFLX is at 7.50% or $64.35 in dollar terms.

How would straddles have performed if you took them? Because NFLX has had very poorly defined expected moves, generally, the one week short straddle has performed terribly of the last eleven times, with it failing 7 of the last 11, making options selling very unprofitable for NFLX (buying direction has worked, however). Yet the one day short straddle performs worse than the one week straddle, by percentage lost. As such, if you do sell premium, better take gains a week after earnings and IV crush. Long Straddles (one day) where you go long and short the stock on both sides has generally well due to the poorly defined expected moves. If you are looking to sell for premium here be very careful and pick wide strikes. If you are buying direction, generally up has worked, but NFLX has very poorly defined moves so be careful.

You can once again see more at unusualwhales.com/stock/NFLX/earnings

Below you can see all company earnings at https://unusualwhales.com/earnings?formats=table&order=report_date&order_direction=asc&min_options_vol=500

January 21, 2025

Netflix (NFLX) expects a significant stock movement of approximately 64.35%, forecasting an EPS of $4.19, with the report scheduled postmarket.

Schwab Charles (SCHW) expects a 3.84% stock movement with an EPS of $0.9, reporting premarket.

Capital One Financial (COF) expects a 9.59% movement with an EPS of $2.66, reporting postmarket.

Horton D R (DHI) projects a significant 6.93% stock movement with an EPS of $2.41, reporting premarket.

Interactive Brokers (IBKR) expects a significant 12.75% movement in its stock with an EPS of $1.86, reporting postmarket.

Seagate Technology Holdings anticipates a 5.54% movement with an EPS of $1.67, reporting postmarket.

KeyCorp expects a subtle 0.67% movement in its stock with an EPS of $0.33, reporting premarket.

United Airlines Holdings (UAL) expects a substantial 9.77% stock movement with an EPS of $3.01, reporting postmarket.

January 22, 2025

Procter & Gamble (PG) anticipates a stock movement of about 4.57% with an EPS estimate of $1.87, reporting premarket.

Johnson & Johnson (JNJ) is set for a 3.20% expected move in its stock price with an anticipated EPS of $2.00, reporting premarket.

Abbott Laboratories (ABT) expects a 3.55% stock movement with an EPS forecast of $1.34, reporting premarket.

GE Vernova projects a 21.63% stock movement with an EPS estimate of $2.3, reporting premarket.

ICICI Bank (IBN), based in India, anticipates a 1.35% stock movement with an EPS of $0.35, but the report time is unknown.

Amphenol (APH) projects a 4.81% movement in its stock with an EPS of $0.5, reporting premarket.

Kinder Morgan (KMI) projects a subtle 0.95% movement in its stock with an EPS of $0.33, reporting postmarket.

Ally Financial anticipates a 2.37% stock movement with an EPS of $0.59, reporting premarket.

Halliburton (HAL) projects a 1.08% movement with an EPS of $0.7, reporting premarket.

Las Vegas Sands (LVS) projects a 1.57% movement in its stock with an EPS of $0.62, but the report time is unknown.

Crown Castle (CCI) anticipates a 5.06% movement with an EPS of $1.74, although the report time is unknown.

January 23, 2025

Intuitive Surgical (ISRG) expects a notable stock movement of 25.38% with an EPS of $1.4, and will report postmarket.

General Electric (GE) anticipates a 9.58% movement in its stock with an EPS estimate of $1.02, reporting premarket.

Texas Instruments (TXN) projects a 9.50% movement in its stock with an EPS of $1.19, scheduled to report postmarket.

American Airlines Group (AAL) projects a 1.23% stock movement with an EPS of $0.64, reporting premarket.

Xerox Holdings expects a 1.19% movement with an EPS of $0.52, but the report time is unknown.

CSX anticipates a 1.06% stock movement with an EPS of $0.43, reporting postmarket.

Freeport-McMoRan (FCX) expects a 1.69% movement with an EPS of $0.29, reporting premarket.

SLM anticipates a 2.15% stock movement with an EPS of $0.55, reporting postmarket.

January 24, 2025

American Express (AXP) projects a substantial 11.69% stock movement with an EPS forecast of $3.03, reporting premarket.

Verizon Communications (VZ) is set for a 1.36% expected move with an EPS of $1.09, reporting premarket.

Here are the economic events for the week:

Here is the economic calendar this week. More at unusualwhales.com/economic-calendar:

Wednesday, January 22:

U.S. Leading Economic Indicators for December are reported at 7:00 AM PST, with a forecast of 0.3%. This indicator helps provide insight into future economic activity.

Thursday, January 23:

Initial Jobless Claims for January are reported at 5:30 AM PST. This weekly data provides insights into the number of filings for unemployment benefits.

Friday, January 24:

S&P Flash U.S. Manufacturing PMI for January is reported at 6:45 AM PST, with a forecast of 49.4. This indicates contraction in the manufacturing sector as it is below 50.

S&P Flash U.S. Services PMI for January is also reported at 6:45 AM PST, with a forecast of 56.8, suggesting expansion in the services sector.

Consumer Sentiment (Final) for January is reported at 7:00 AM PST, with a forecast of 73.2. This metric gauges the overall health of consumer attitudes towards the economy.

Existing Home Sales for December are reported at 7:00 AM PST, with an expected figure of 4.2 million. This data provides insight into the health of the residential real estate market.

We also just announced a brand new API allowing you to build out your own private dashboards, or enterprise clients to scale out their financial tooling. Come check out the public api! We have tons of data available for the API, so come check it out and get started building that dream application, or enhance your desks toolset with our proprietary data!

Thank you as always for reading and have a great week!

I’m noticing that these stocks are moving most of the way up a week before earnings. How far ahead do you find out the expected?