Jerome Powell and Jackson Hole this week, and PANW Earnings Upcoming

Everything you need to know about the markets in three minutes or less

🍒Get a $50-$5000 bonus when you open an tastytrade x UW account🍒

Good evening.

Let’s see what is upcoming in the markets this upcoming week, and what happened this week quickly before the week begins!

Looking at the markets last week, we had an incredibly insane week after the had the third largest VIX print ever, SPY rallied 3.44% for the week. Here is what that looked like in the heatmaps:

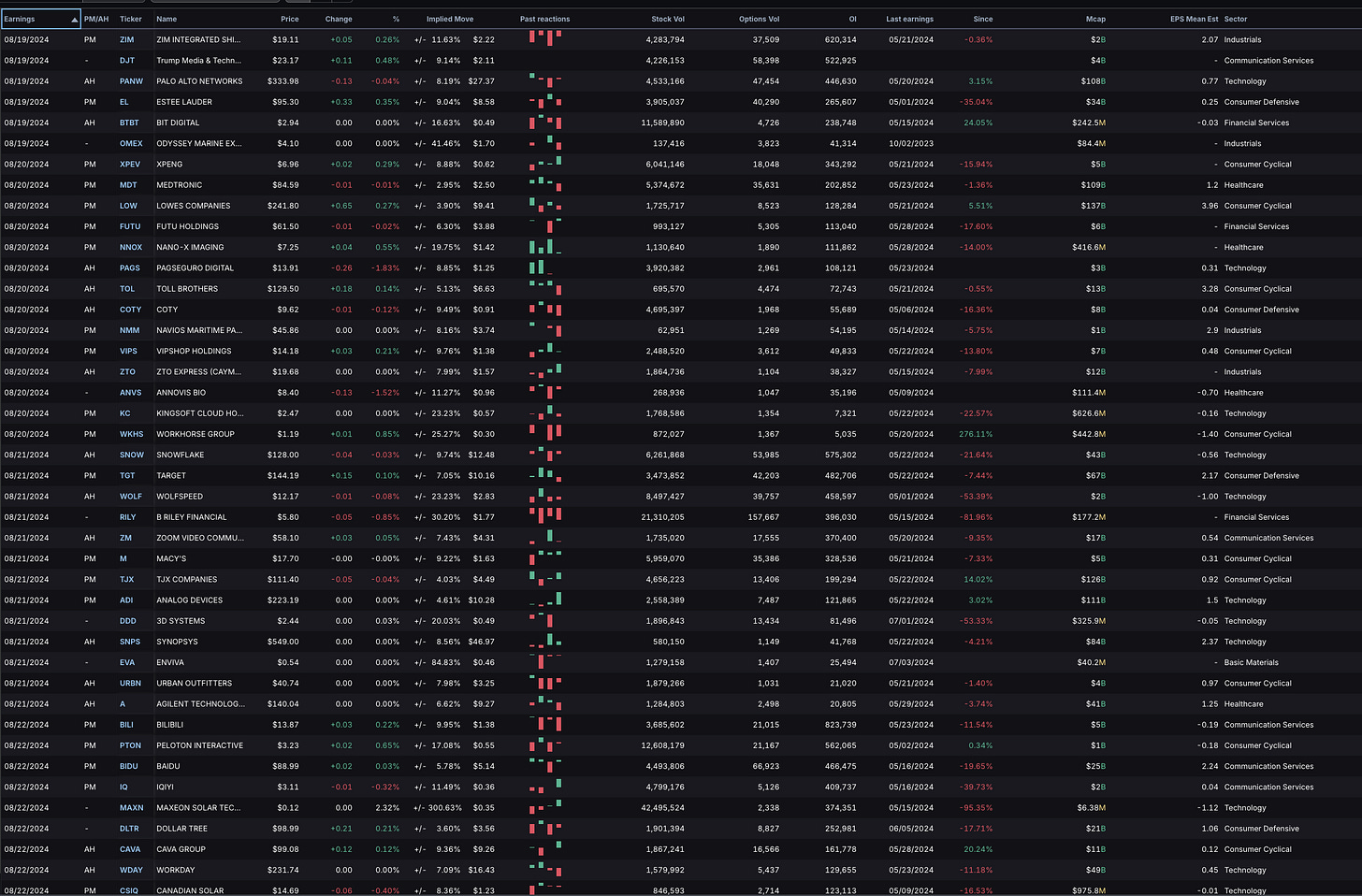

Here are the upcoming earnings this week, including the expected moves, EPS mean estimates, and notable details. See more at unusualwhales.com/earnings. We also updated our earnings breakdowns to show you historical moves and predictions!

August 19, 2024

ZIM Integrated Shipping Services (ZIM) expects an EPS of 2.07 with an implied move of 2.2171, open interest of 620314, and a stock volume of 4283794.

Trump Media & Technology Group (DJT) has an expected implied move of 2.1077, open interest of 522925, and a stock volume of 4226153.

Palo Alto Networks (PANW) expects a street EPS of 1.409 with an implied move of 27.3738, open interest of 446630, and a stock volume of 4533166.

Estee Lauder (EL) expects an EPS of 0.25 with an implied move of 8.5821, open interest of 265607, and a stock volume of 3905037.

Bit Digital (BTBT) expects a street EPS of -0.027 with an implied move of 0.4888, open interest of 238748, and a stock volume of 11589890.

Odyssey Marine Exploration (OMEX) expects an implied move of 1.7001, open interest of 41314, and a stock volume of 137416.

August 20, 2024

XPeng (XPEV) expects an implied move of 0.6163, open interest of 343292, and a stock volume of 6041146.

Medtronic (MDT) expects a street EPS of 1.197 with an implied move of 2.4990, open interest of 202852, and a stock volume of 5374672.

Lowe's Companies (LOW) expects a street EPS of 3.956 with an implied move of 9.4137, open interest of 128284, and a stock volume of 1725717.

Futu Holdings (FUTU) expects an implied move of 3.8768, open interest of 113040, and a stock volume of 993127.

Nano-X Imaging (NNOX) expects an implied move of 1.4240, open interest of 111862, and a stock volume of 1130640.

PagSeguro Digital (PAGS) expects a street EPS of 0.307 with an implied move of 1.2538, open interest of 108121, and a stock volume of 3920382.

Toll Brothers (TOL) expects a street EPS of 3.282 with an implied move of 6.6303, open interest of 72743, and a stock volume of 695570.

Coty (COTY) expects a street EPS of 0.04 with an implied move of 0.9138, open interest of 55689, and a stock volume of 4695397.

Navios Maritime Partners LP (NMM) expects a street EPS of 2.9 with an implied move of 3.7402, open interest of 54195, and a stock volume of 62951.

VIPShop Holdings (VIPS) expects a street EPS of 0.54 with an implied move of 1.3813, open interest of 49833, and a stock volume of 2488520.

ZTO Express (Cayman) (ZTO) expects an implied move of 1.5725, open interest of 38327, and a stock volume of 1864736.

Annovis Bio (ANVS) expects a street EPS of -0.7 with an implied move of 0.9613, open interest of 35196, and a stock volume of 268936.

Kingsoft Cloud Holdings (KC) expects a street EPS of -0.16 with an implied move of 0.5738, open interest of 7321, and a stock volume of 1768586.

Workhorse Group (WKHS) expects a street EPS of -1.4 with an implied move of 0.2982, open interest of 5035, and a stock volume of 872027.

August 21, 2024

Snowflake (SNOW) expects a street EPS of 0.15 with an implied move of 12.4758, open interest of 575302, and a stock volume of 6261868.

Target (TGT) expects a street EPS of 2.175 with an implied move of 10.1586, open interest of 482706, and a stock volume of 3473852.

Wolfspeed (WOLF) expects a street EPS of -0.819 with an implied move of 2.8296, open interest of 458597, and a stock volume of 8497427.

B Riley Financial (RILY) expects an implied move of 1.7667, open interest of 396030, and a stock volume of 21310205.

Zoom Video Communications (ZM) expects a street EPS of 1.214 with an implied move of 4.3135, open interest of 370400, and a stock volume of 1735020.

Macy's (M) expects a street EPS of 0.315 with an implied move of 1.6314, open interest of 328536, and a stock volume of 5959070.

TJX Companies (TJX) expects a street EPS of 0.922 with an implied move of 4.4878, open interest of 199294, and a stock volume of 4656223.

Analog Devices (ADI) expects a street EPS of 1.5 with an implied move of 10.2850, open interest of 121865, and a stock volume of 2558389.

3D Systems (DDD) expects a street EPS of -0.015 with an implied move of 0.4888, open interest of 81496, and a stock volume of 1896843.

Synopsys (SNPS) expects a street EPS of 3.28 with an implied move of 46.9713, open interest of 41768, and a stock volume of 580150.

Enviva (EVA) expects an implied move of 0.4581, open interest of 25494, and a stock volume of 1279158.

Urban Outfitters (URBN) expects a street EPS of 0.975 with an implied move of 3.2513, open interest of 21020, and a stock volume of 1879266.

Agilent Technologies (A) expects a street EPS of 1.253 with an implied move of 9.2651, open interest of 20805, and a stock volume of 1284803.

Bilibili (BILI) expects a street EPS of -0.1 with an implied move of 1.3773, open interest of 823739, and a stock volume of 3685602.

Peloton Interactive (PTON) expects a street EPS of -0.183 with an implied move of 0.5483, open interest of 562065, and a stock volume of 12608179.

Baidu (BIDU) expects a street EPS of 2.68 with an implied move of 5.1413, open interest of 466475, and a stock volume of 4493806.

IQIYI (IQ) expects a street EPS of 0.06 with an implied move of 0.3585, open interest of 409737, and a stock volume of 4799176.

Maxeon Solar Technologies (MAXN) expects a street EPS of -1.12 with an implied move of 0.3496, open interest of 374351, and a stock volume of 42495524.

Dollar Tree (DLTR) expects a street EPS of 1.057 with an implied move of 3.5560, open interest of 252981, and a stock volume of 1901394.

Cava Group (CAVA) expects a street EPS of 0.123 with an implied move of 9.2650, open interest of 161778, and a stock volume of 1867241.

Workday (WDAY) expects a street EPS of 1.626 with an implied move of 16.4315, open interest of 129655, and a stock volume of 1579992.

Canadian Solar (CSIQ) expects a street EPS of -0.01 with an implied move of 1.2327, open interest of 123113, and a stock volume of 846593.

Advance Auto Parts (AAP) expects a street EPS of 0.999 with an implied move of 7.3034, open interest of 116102, and a stock volume of 995515.

Toronto Dominion Bank (TD) expects a street EPS of 1.507 with an implied move of 2.1889, open interest of 75673, and a stock volume of 1165283.

Intuit (INTU) expects a street EPS of 1.855 with an implied move of 32.0481, open interest of 73444, and a stock volume of 765414.

Bill Holdings (BILL) expects a street EPS of 0.458 with an implied move of 6.4761, open interest of 68385, and a stock volume of 1811387.

Weibo (WB) expects a street EPS of 0.445 with an implied move of 0.5313, open interest of 65575, and a stock volume of 1755157.

Domo (DOMO) expects a street EPS of -0.285 with an implied move of 0.9441, open interest of 65558, and a stock volume of 773833.

Ross Stores (ROST) expects a street EPS of 1.493 with an implied move of 7.8192, open interest of 58422, and a stock volume of 3117156.

Opera (OPRA) expects a street EPS of 0.17 with an implied move of 1.5302, open interest of 49580, and a stock volume of 335932.

NetEase (NTES) expects a street EPS of 1.79 with an implied move of 4.6685, open interest of 48582, and a stock volume of 1802586.

August 23, 2024

VinFast Auto Ltd (VFS) expects a street EPS of -0.24 with an implied move of 0.4730, open interest of 100980, and a stock volume of 788210.

Immersion (IMMR) expects a street EPS of 0.5 with an implied move of 1.3176, open interest of 35362, and a stock volume of 852608.

Before we get to the economic data, Unusual Whales has partnered with Tema ETFs and their $HRTS ETF, the GLP-1 ETF for the earnings of Eli Lilly, $LLY, & Novo Nordisk, $NOVO.

Novo Nordisk, $NOVO, earnings reported:

- Net profit: 20.05 billion Danish kroner ($2.93 billion), est: $20.9 Danish kroner

- Raised 2024 outlook, sales growth 19% / 27%

Eli Lilly, $LLY, earnings reported:

- Revenue: $11.30 billion

- Raised revenue guidance by $3 billion; EPS increased 68% to $3.28 on a reported basis

The actively managed Tema GLP-1, Obesity and Cardiometabolic ETF aims to generate long-term capital growth via investment in GLP-1 and weight loss companies combating obesity and cardiometabolic diseases. Tema notes that obesity is on the cusp of a therapeutics revolution, while the leading cause of death, heart disease, witnesses a renaissance of therapies, driven by genetic insights and tools. Tema aims to utilize their team’s investment and scientific expertise to navigate the regulatory and financing risks of this secular theme.

Check them out! Back to economic data:

Here is the economic calendar this week. More at unusualwhales.com/economic-calendar:

Monday, August 19:

Fed Governor Christopher Waller will provide welcoming remarks at 6:15 AM.

U.S. leading economic indicators for July are expected to show a decline of -0.4%, a reversal from the previous increase of 0.2%, reported at 7:00 AM.

Tuesday, August 20:

Atlanta Fed President Raphael Bostic is scheduled to speak at 10:35 AM.

Fed Vice Chair for Supervision Michael Barr will give a speech at 11:45 AM.

Wednesday, August 21:

The minutes from the Fed's July FOMC meeting will be released at 11:00 AM, providing insights into the Federal Reserve's monetary policy deliberations.

Thursday, August 22:

Initial jobless claims for August are expected to be 230K, slightly up from the previous 227K, reported at 5:30 AM.

S&P flash U.S. manufacturing PMI for August is expected to be 49.6, indicating slight contraction in the manufacturing sector, reported at 6:45 AM.

S&P flash U.S. services PMI for August is anticipated to be 55, suggesting continued expansion in the services sector, also reported at 6:45 AM.

Existing home sales for July are expected to be 4M, up from 3.9M, reported at 7:00 AM.

Friday, August 23:

New home sales for July are forecasted to be 625K, up from 617K, reported at 7:00 AM.

Fed Chair Jerome Powell is scheduled to speak at the Jackson Hole retreat at 7:00 AM, an event closely watched for hints on the future direction of U.S. monetary policy.

Thank you as always for reading and have a great week! If you want to be part of our Twitter Space on Wednesday, please Come check it out and reserve a spot to listen on Twitter.

We also just built a portfolio analyzer, trading journal, dividend tracker, and all around great software for you to see how you trade. Connect your broker and get your trades analyzed and leveled up today!

NOTE: This post is not financial advice. The stock market is risky, and any trade or investment is expected to have some, or total, loss. Please do research before any trade. Do not use this information for investment decisions. Check terms on site for full terms. Agree to terms before considering this information.