How Senator Thomas Carper became rich through stock trading in his forty year career

As part of our weekly educational series

This month, Senator Thomas Carper announced his retirement. He has been in office for 40 years. In that time he became a multimillionaire many times over. In fact, he was one of the best traders in Congress.

Seriously, take a look:

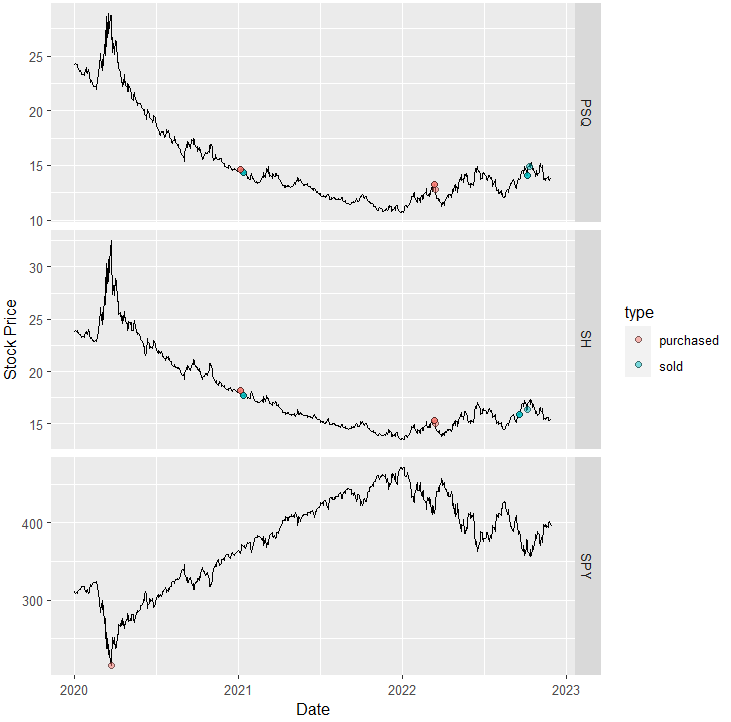

The market is down significantly from its July peak. But guess who shorted/hedged their portfolio at the top, Thomas Carper. He bought 30k in $PSQ, an ultrashort $QQQ index, on July 13, and is up nearly 9% on this position while the SPY is down ~5% in the same time.

This is not the first time he did so. Thomas Carper bought up to $200k in bearish ETFs before the huge rate hikes and CPI data from the federal reserve. He sits on the Senate Finance Committee. On October 4th, Senator Thomas Carper has sold his short on the US economy, with the ProShares Short S&P500, $SH. He reported selling up to $80,000 shares on Sept 19, originally purchased March 2022. He made around 4% on the sale. His short positions were up approximately 5-20% on the SPY, as well as his PSQ positions. Carper’s PSQ, and SH sales were incredible, as were his buying of SPY at the bottom of the covid crash. You should really see these charts below:

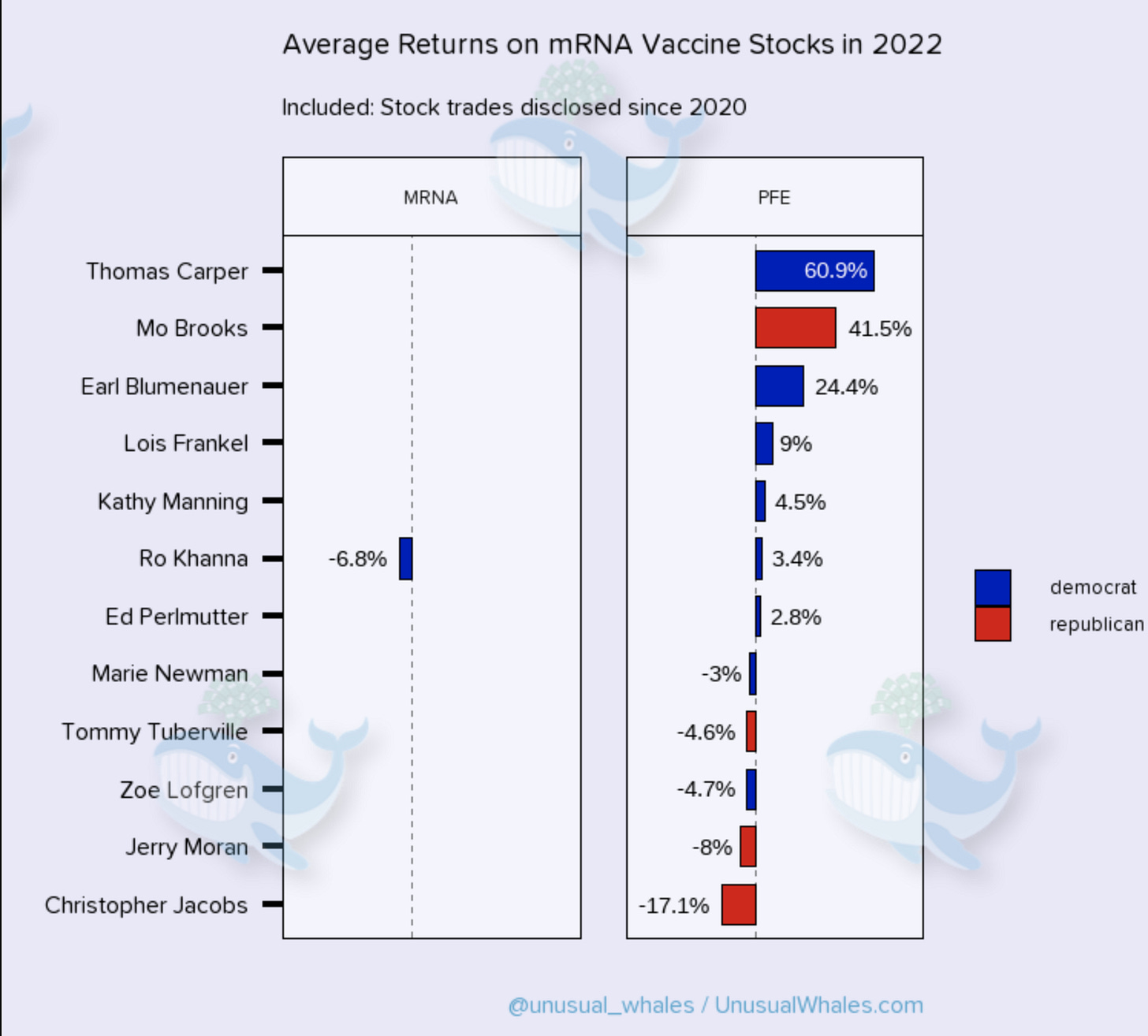

Carper bought heavy into Pfizer, $PFE, in 2020 before vaccines were announced. His returns on average in pharmaceuticals are close to 100%. On 2020-04-02, he purchased $NVO, a Danish pharmaceutical company which lobbies and testifies to Senate Health Committees. He was up 180%. He had the best Pfizer returns in ALL OF CONGRESS! Here is an image from our 2021 study of his returns:

You can see a full breakdown of his current portfolio, history of conflicts and trades below, if you are a subscriber. We appreciate the support given the time it takes for us to research and write these reports!

Keep reading with a 7-day free trial

Subscribe to Unusualwhales Newsletter to keep reading this post and get 7 days of free access to the full post archives.