How crypto miners and traders followed the bullish crypto ETF news, and UW Christmas Sale

As part of our free weekly educational newsletter to help you understand options

Hey all,

This is the Unusual Whales Team, and we are going to spend every Wednesday walking you through some trades of the week for free to help your trading!

Before we get into it know that Unusual Whales is having a 🎅Christmas/Holiday Sale for the holidays!! 🎅 Get 15% off all tiers, and 20% off when you upgrade your account! This is the one of the best sales of the season so click here to check it out. For those who want to🎁 gift a UW membership🎁 to another user, you can using this link!

In today’s issue, we’re going to look at some holiday flow on Marathon Digital Holdings, Inc. $MARA. $MARA had unusual bullish options activity on both calls and puts during the week preceding the holidays, and it’s safe to say the traders behind the flow got a little holiday cheer from their trades. So let’s break it down.

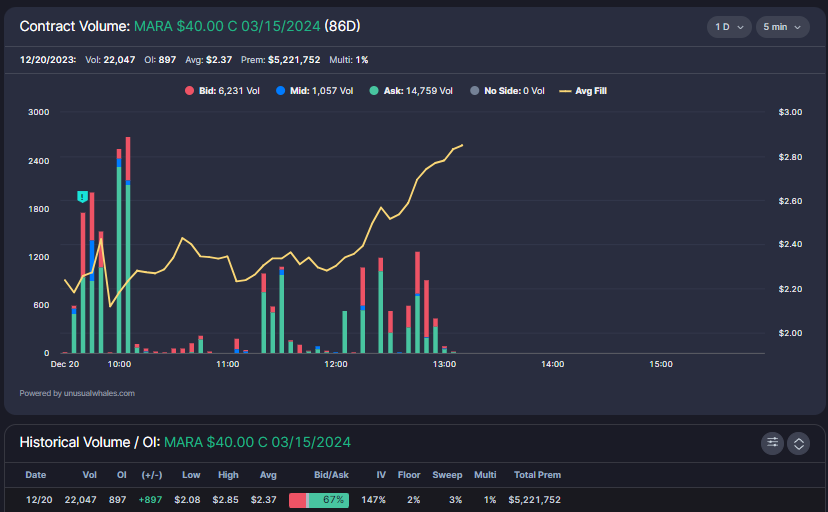

The first chain we’re going to look into is the $40C 3/15/2024. On December 20, we observed repeat action in the morning. 10,000+ volume transacted during the first few hours after market open, and more trickled in throughout the day to bring the tally to over 22,000 volume transacted.

A bit of a mixed bag, but diving into the flow feed itself, we can see that the majority of the flow, and the earliest flow between 9:30am and 10:15am was ask side and at the ask of $2.21 to $2.50 with an ascending fill, and 67% of the volume across the whole day was ask side. At the time of these $40 call fills, $MARA was trading in a range between $22.75 and $23.48 per share.

That’s the initial build-up on the $40C 03/15/2024. Before we get to the results of the trade, I want to take a look at the put contracts that also transacted on 12/20.

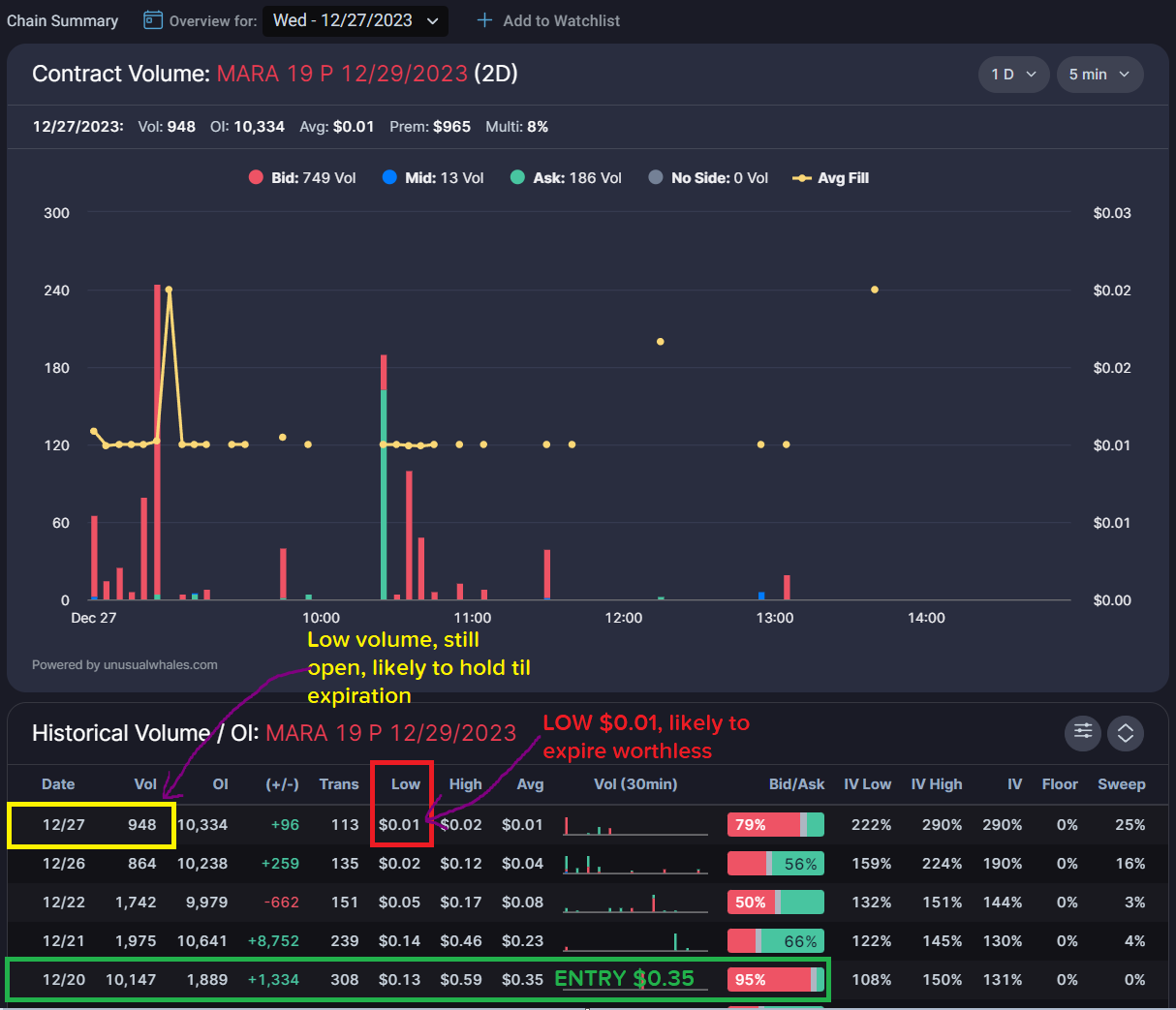

At 13:05:38 EST, a rush of volume hit the tape on the $19P 12/29/2023. The bid-ask spread at the time was $0.35 - $0.37 and shifted to $0.36 - $0.37, so with fills of $0.35 - 0.36, these hit right at the bid, lending speculation that these were sold to open (aka “written”).

Reminder: Put writing is a bullish options strategy wherein you sell the puts to open and receive a credit; the goal is for the stock price to rise, causing the puts to drop in value. The trader is able to keep the difference between what they received for writing the contracts and the current price of the contract.

$MARA stock traded at $23.63 when these orders filled, and with a 12/29 expiration date, this trader was playing for a sharp pop in stock price to occur in a relatively short amount of time.

By the end of the day on 12/20, our put writer was in the negative by a factor of around $18 per contract, as the $19P ended the trading session at $0.54 per contract. But remember, time is a factor on written puts–our trader held, and got their reward the following week.

Before we get into the results these two traders enjoyed, please take a moment to check out today’s sponsor, Cybeats! (OTC: CYBCF)

Cybeats is a rapidly expanding cybersecurity company focused on software security solutions. It offers a Software as a Service (SaaS) product named "SBOM Studio," which scans software for vulnerabilities and threats, facilitates regulatory compliance by sharing SBOMs with government agencies, and provides a centralized tool for managing cyber risk. Cybeats has been providing services to U.S. infrastructure and Fortune 500 companies. The company is attempting to be positioned as a crucial player in the growing market for software safety and compliance, with the SBOM market expected to grow substantially. Below is more information on SBOM, and how Cybeats is working to enhance cybersecurity:

Thanks for taking the time to read about our sponsor Cybeats! Now let’s see how our $MARA traders did.

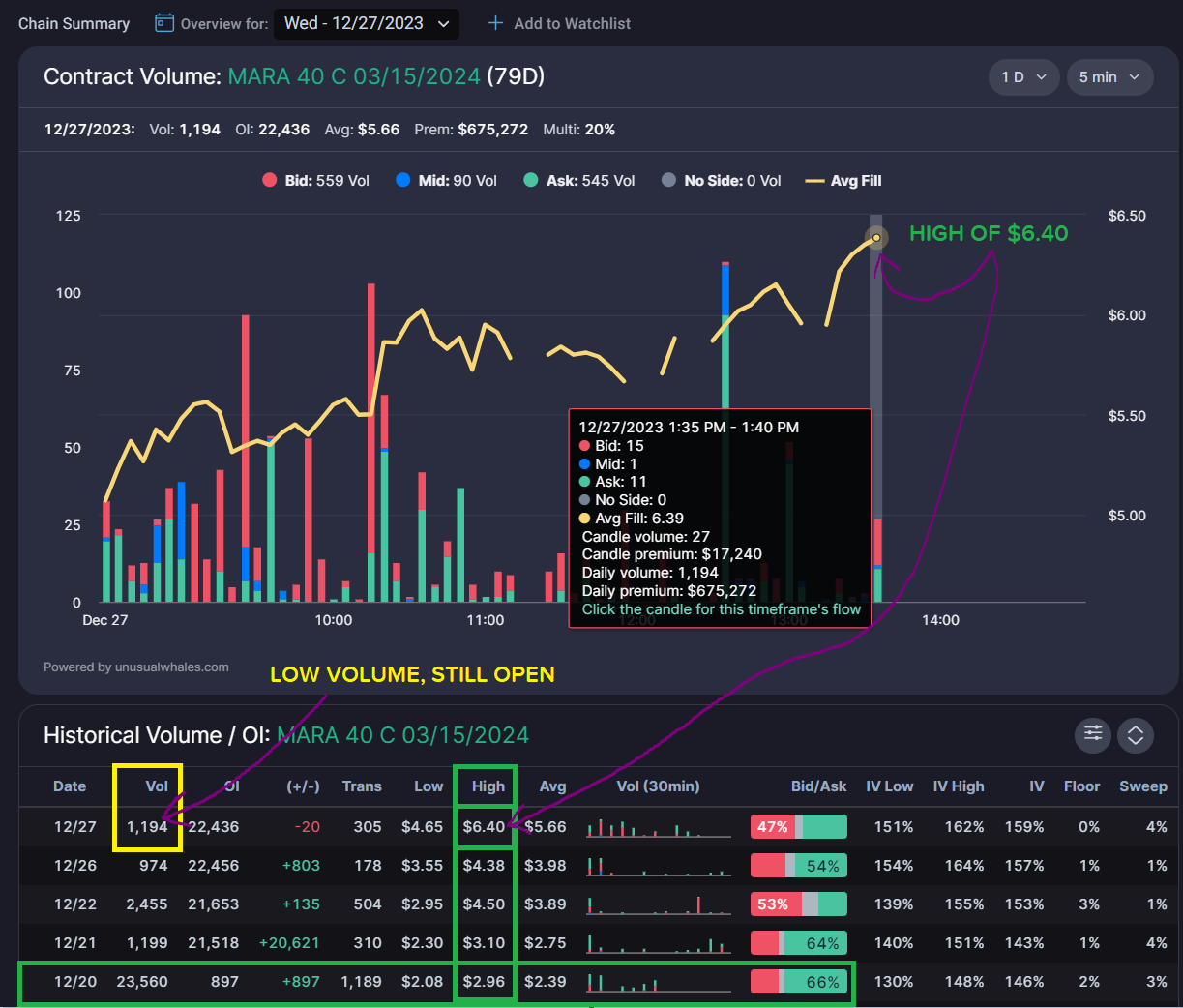

Since December 20th, the $MARA stock price has risen substantially, and at the time of writing on 12/27, is up nearly 32%. Remember, the stock was trading between $22 and $24 per share when both of our traders opened their respective positions, so on 12/27 with a stock price of of over $31, both of our traders enjoyed a nice holiday gift. Let’s start with the $40C 3/15/2024.

Shortly before market close on 12/27, the $40C 03/15/2024 hit a new high of $6.40 per contract. From our trader’s entry ranging from $2.21 to $2.50, this is a minimum gain of 156%, and a maximum gain of 189.6% for their contracts.

The $19P for 12/29/2023 tells a similar success story.

From the average entry of $0.36 per contract, the $19P 12/29/2023 as of 12/27 has essentially dropped to $0. For the put writer, this is great news, because it means they can choose to close their position here and buy the contracts back for $0.01 a piece, and profit $35 per contract. However, as we can see in yellow, there has been no volume and this position is still open. The odds are this trader may hold until the contract expires, allowing them to retain the entire credit they received when they opened their position.

So let’s recap:

$40C 03/15/2024: $2.21 - $2.52 → $6.40 | +156 - 189.6%

$19P 12/29/2023: $0.36 → $0.01 | +100%

Both trades are still open

To clear up some of the terminology used in this article that you may not be familiar with, there are numerous educational resources on Options Basics, Misconceptions, Greeks, and Finding and Tracking Flow over on the Unusual Whales Education page!

Reminder that our sponsor today is Cybeats; check them out to learn about their SBOM product and endeavors in software security!

Once again, we hope you enjoy the upcoming holiday season with your families and friends! Checkout out the Christmas sale that ends in a few days if you are interested in trying out our tools or supporting our software!

NOTE: This post is not financial advice. The stock market is risky, and any trade or investment is expected to have some, or total, loss. Please do research before any trade. Do not use this information for investment decisions. Check terms on site for full terms. Agree to terms before considering this information.

NOTE: Unusual Whales is not responsible for any promotion. Our promotion has paid us, either directly or via subcontracting. In Cybeats’s case, they have paid a marketing company that has contracted our placement in our newsletter. Unusual Whales has been contracted by the marketing company for placement in their newsletter, and are paid USD for such a placement. You can read our full terms here: unusualwhales.com/terms

NOTE: Unusual Whales is not responsible for any promotion. It does not verify the authenticity of the promotion or partnership, nor the merits of the individual promotion. Unusual Whales does not necessarily endorse any one promotion. Please do your own diligence and research before following any one promoted post. Do not consider a promotion of a post an advocation for the sponsor of the post. Do not invest because of any promotion. Do not follow any promotion unless you yourself think it worthwhile. Unusual Whales is not affiliated with any sponsor. Unusual Whales is being paid to promote the promotion. The post itself is an ad, and not a reflection of Unusual Whales itself. Please check full terms for details.