Earnings and Economic Calendar for the Week before FOMC

Everything you need to know about the markets in three minutes or less

🛏 JOIN EIGHT SLEEP WITH CODE WHALES FOR $350 OFF! 🛏

Hi there!

Let’s see what is upcoming in the markets this upcoming week, and what happened this week quickly before the week begins!

Before I begin, we just released a tool we’ve been developing in house for numerous months called Periscope. You can find a write up for it below, and a link for the tool here: Periscope link.

Looking at last week’s markets, the markets fell all week, down 1.30% for the week after Trump tariff and market news, but rallied at the end having its best day of the year after a brutal Monday/Tuesday fall. The market has been reacting negatively to tariff news all week, with the market down 0.82% this week, and now down YTD, down 3.36 YTD%. Here is what that looked like in the heatmaps:

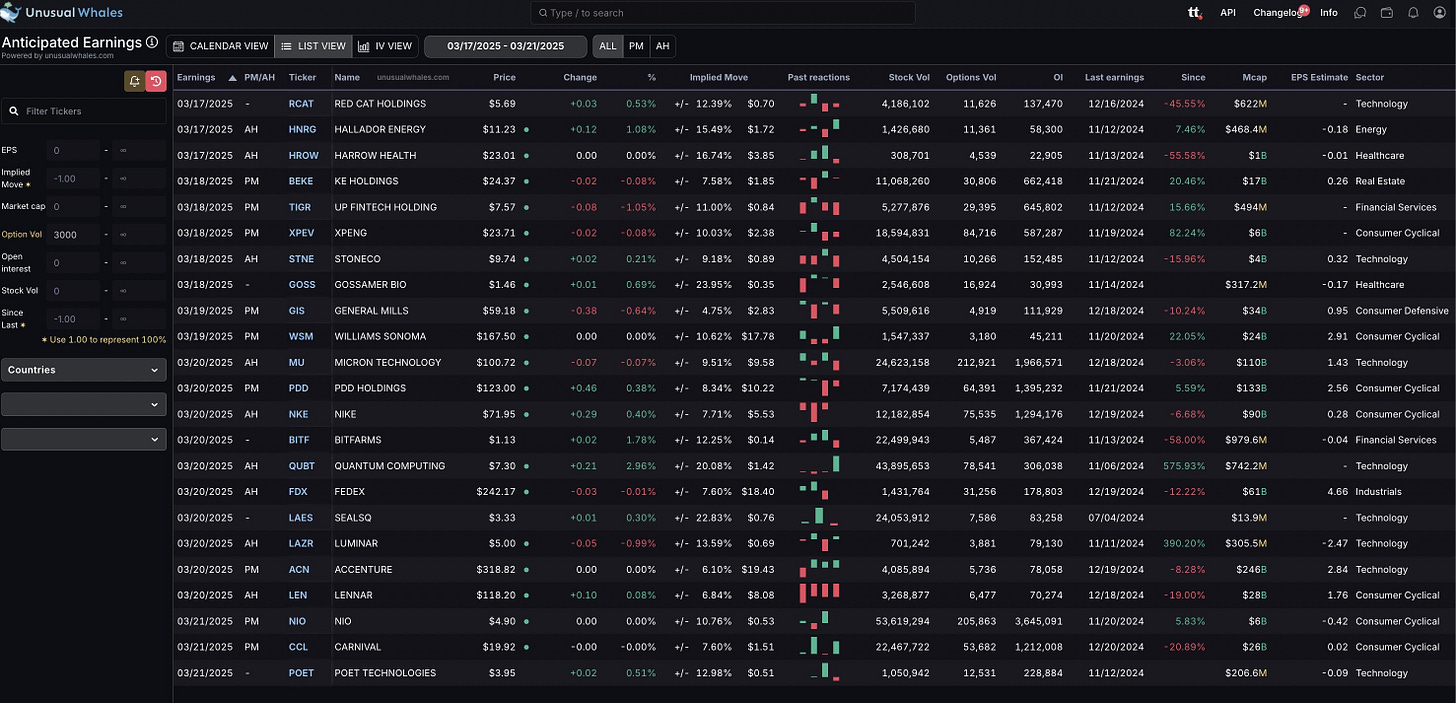

Here are the upcoming earnings this week, including the expected moves, EPS mean estimates, and notable details. See more at unusualwhales.com/earnings.

For reference, there is a huge week of earnings ahead.

Below you can see all company earnings at https://unusualwhales.com/earnings?formats=table&order=report_date&order_direction=asc&min_options_vol=500

Report Date: 2025-03-18

KE Holdings (BEKE) reports pre-market with an expected stock move of $1.85, expected EPS of 0.19, a stock volume of 11,068,260, and options volume of 30,806.

UP Fintech Holding (TIGR) also reports pre-market with an expected stock move of $0.84, expected EPS not provided, a stock volume of 5,277,876, and options volume of 29,395.

XPeng (XPEV) will report pre-market with an expected stock move of $2.38, expected EPS not provided, a stock volume of 18,594,831, and options volume of 83,716.

StoneCo (STNE) reports post-market with an expected stock move of $0.89, expected EPS of 0.32, a stock volume of 4,504,154, and options volume of 10,266.

Report Date: 2025-03-19

General Mills (GIS) reports pre-market with an expected stock move of $2.83, expected EPS of 0.95, a stock volume of 5,509,616, and options volume of 4,919.

Williams Sonoma (WSM) also reports pre-market with an expected stock move of $17.78, expected EPS of 2.91, a stock volume of 1,547,337, and options volume of 10,678.

Before we get to the results of these two $DAL trades, I want to tell you about Eight Sleep as it changed the way I sleep for the better.

Numerous neuroscientists like Andrew Huberman have already raved about it, but it goes without saying: my sleep has improved so much with Eight Sleep that even as a whale I cannot tell you how unusual it is. It helps you cool, heat, track and ultimately sleep better. There is no other product like it. Truly.

As a result, I partnered with Eight Sleep to get you guys a discount for a product I love. Head over to www.eightsleep.com/whales/ https://www.eightsleep.com/ca/whales/) and use the code WHALES to get $350 off your very own Pod 4 Ultra, which is customized to your sleep settings. If you sleep better, you'll likely trade better, too!

Join the warm waters at Eight Sleep, and focus on all trader's foundation: their sleep! Join here.

Report Date: 2025-03-20

Micron Technology (MU) reports post-market with an expected stock move of $9.58, expected EPS of 1.28, a stock volume of 24,623,158, and options volume of 213,921.

PDD Holdings (PDD) reports pre-market with an expected stock move of $10.22, expected EPS of 2.31, a stock volume of 7,174,439, and options volume of 63,391.

Nike (NKE) reports post-market with an expected stock move of $5.53, expected EPS of 0.28, a stock volume of 12,182,854, and options volume of 66,935.

Quantum Computing (QUBT) reports post-market with an expected stock move of $1.42, expected EPS not provided, a stock volume of 43,895,653, and options volume of 78,627.

FedEx (FDX) reports post-market with an expected stock move of $18.40, expected EPS of 4.66, a stock volume of 1,431,764, and options volume of 30,253.

Accenture (ACN) reports pre-market with an expected stock move of $19.43, expected EPS of 2.84, a stock volume of 4,085,894, and options volume of 5,736.

Lennar (LEN) reports post-market with an expected stock move of $8.08, expected EPS of 1.76, a stock volume of 3,268,877, and options volume of 6,424.

Report Date: 2025-03-21

Nio (NIO) reports pre-market with an expected stock move of $0.53, expected EPS of -0.42, a stock volume of 53,619,294, and options volume of 192,943.

Carnival (CCL) reports pre-market with an expected stock move of $1.51, expected EPS of 0.02, a stock volume of 22,467,722, and options volume of 53,682.

Here are the economic events for the week (reminder, we added a Trump calendar seen here: https://unusualwhales.com/trump-tracker)

Here is the economic calendar this week. More at unusualwhales.com/economic-calendar:

Monday, March 17:

Empire State Manufacturing Survey for March is reported at 5:30 AM PDT, expected to show a reading of 5.7, indicating modest manufacturing growth in New York State.

Retail Sales Minus Autos for February are expected to decrease by -0.4%, and overall U.S. Retail Sales are expected to show a more significant decrease of -0.9%, both reported at 5:30 AM PDT.

Home Builder Confidence Index for March is anticipated to be at 42, reported at 7:00 AM PDT, reflecting the mood in the residential construction market.

Business Inventories for January are expected to show a decrease of -0.2%, also reported at 7:00 AM PDT.

Tuesday, March 18:

Import Price Index Minus Fuel for February is expected to show a slight increase of 0.1%, and the overall Import Price Index is expected to show a higher increase of 0.3%, both reported at 5:30 AM PDT.

Building Permits for February are expected to be at 1.5 million, and Housing Starts are expected to be slightly lower at 1.4 million, also reported at 5:30 AM PDT.

Capacity Utilization for February is forecasted at 77.8%, and Industrial Production is expected to increase by 0.5%, both reported at 6:15 AM PDT.

Wednesday, March 19:

FOMC Interest-Rate Decision is a critical event, scheduled for 11:00 AM PDT. It will be closely watched for any changes or indications of future monetary policy.

Fed Chair Powell Press Conference follows at 11:30 AM PDT, likely providing further insights into the Federal Reserve's views on the economy and policy directions.

Thursday, March 20:

Philadelphia Fed Manufacturing Survey for March is reported at 5:30 AM PDT, expected to show a robust index of 18.1, indicating strong manufacturing growth in the Philadelphia region.

Initial Jobless Claims for March are also reported at 5:30 AM PDT, providing weekly insights into the number of people filing for unemployment benefits.

U.S. Leading Economic Indicators for February are expected to show a modest increase of 0.3%, reported at 7:00 AM PDT, suggesting future economic activity trends.

Existing Home Sales for February are expected to be reported at 4.1 million, also at 7:00 AM PDT, providing an update on the state of the residential real estate market.

We also just announced a brand new API allowing you to build out your own private dashboards, or for enterprise clients to scale out their financial tooling and data with full customization. Come check out the public api! We have tons of data available for the API, so come check it out and get started building that dream application, or enhance your desks toolset with our proprietary data! Come check it out here: unusualwhales.com/public-api

As a reminder, we also released our new market maker exposure tool, seen here: https://unusualwhales.com/periscope/market-exposure

Thank you as always for reading and have a great week!