Adobe, GameStop, Oracle earnings breakdowns, as well as markets for the week

Everything you need to know about the market in three minutes or less

🍒Get a $50-$5000 bonus when you open an tastytrade x UW account🍒

Hi there!

Let’s see what is upcoming in the markets this upcoming week, and what happened this week quickly before the week begins! We’ll break down company earnings as well as earnings option strategies.

Looking at last week’s markets, the markets rallied however Tesla fell as Donald Trump and Elon feuded on X. Here is what that looked like in the heatmaps:

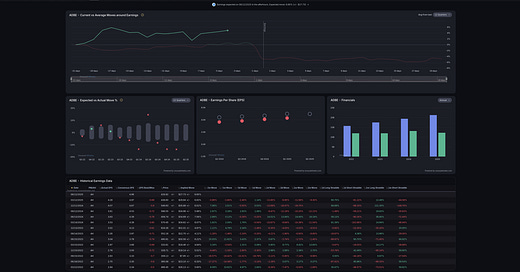

Before we look at all earnings, let’s break down ADBE, Adobe earnings, which you can see a breakdown on Unusual Whales at unusualwhales.com/stock/ADBE/earnings.

To start off, ADBE Adobe earnings are not easily predictable, as a result the market has done a bad job of predicting earnings before the AI push. Now let’s get into it!

Generally over the last 12 quarters, ADBE rises slighty into the days before earnings, then falls after the initial move a few days later, generally down -4% in 21 days after earnings. However, right now it is up a up +4% four days before its earnings (on average it is only 0.1% higher right before earnings).

Over the last 12 quarters, ADBE has large implied moves, with this move being smaller than previous moves. The moves themselves have not been within the expected move bands 9 of the last 11 times, meaning that generally ADBE earnings are not well defined by market makers. If you look at the last seven earnings, they have missed by large margins in the expected vs implied move. ADBE has fallen below its expected move numerous times over the last twelve earnings. ADBE has surprised only twice to the upside, and is mostly at the bottom band of its expected move, so shorting the stock has been a great play into earnings (with an average move of -4% from earnings). As such, on the call and put side selling straddles has been unprofitable due to the larger implied moves, but shorting with equities has outperformed as well. At the moment, the Implied Move (expected move) for ADBE is at 6.65% or $27.73 in dollar terms. This is it’s smaller than last move, where it moved below it’s expected move.

How would straddles have performed if you took them? Because ADBE has had poorly defined expected moves, generally, the one week short straddle has performed poorly 8 of the last 13 times (!!!! which is tough to sell straddles and hold for a week), while buying direction has worked, however via equities, so watch your deltas). Yet the one day short straddle performs actually worse than the one week straddle, as ADBE likes to drop post earnings numerous percent. As such, if you do sell premium, better take gains after a few days and IV crush. If you are looking to sell for premium here be very careful and pick wide strikes, lean bearish historically. Generally though, due to the last earnings swings with ADBE, one might want to avoid ADBE all together.

If you are buying direction, generally down has worked in the long term, but ADBE has had volatile earnings (to the downside, and rallied weeks after earnings) so be careful with your wings, a broken butterfly might be effective here. Ratio spreads might work here, or selling diagonals might be a good idea! Generally, because volatility is lower than normal, be careful of larger moves not priced in.

Here is an example put debit spread, which leans bearish but makes your puts slightly cheaper. IV crush would destroy these, however. Here’s the put debit spread: https://unusualwhales.com/options-profit-calculator/put_debit_spread/ADBE/ADBE250620P00427500,-ADBE250620P00407500

You can see more option strategies at Unusual Whales and our options profit calculator by clicking here.

Below you can see all company earnings at https://unusualwhales.com/earnings?formats=table&order=report_date&order_direction=asc&min_options_vol=500

Tues, June 10

Core & Main (CNM) reports before the open with an expected move of $5.04. EPS is estimated at $0.52. Stock volume is 1.79 million, and options volume is 4,245 contracts.

United Natural Foods (UNFI) reports before the open with an expected move of $3.42. EPS is estimated at $0.24. Stock volume is 559,535, and options volume is 629 contracts.

Academy Sports & Outdoors (ASO) reports before the open with an expected move of $3.56. EPS is estimated at $0.84. Stock volume is 1.39 million, and options volume is 1,129 contracts.

GameStop (GME) reports after the close with an expected move of $2.79. EPS is estimated at $0.08. Stock volume is 4.38 million, and options volume is 186,554 contracts.

GitLab (GTLB) reports after the close with an expected move of $5.95. EPS is estimated at -$0.08. Stock volume is 2.79 million, and options volume is 10,911 contracts.

Dave & Buster’s Entertainment (PLAY) reports after the close with an expected move of $3.41. EPS is estimated at $0.96. Stock volume is 1.12 million, and options volume is 1,806 contracts.

Stitch Fix (SFIX) reports after the close with an expected move of $0.76. EPS is estimated at -$0.12. Stock volume is 1.47 million, and options volume is 3,618 contracts.

June 11

Oracle (ORCL) reports after the close with an expected move of $12.05. EPS is estimated at $1.30. Stock volume is 6.83 million, and options volume is 68,930 contracts.

Chewy (CHWY) reports before the open with an expected move of $4.01. EPS is estimated at $0.16. Stock volume is 4.67 million, and options volume is 31,292 contracts.

SailPoint, Inc. (SAIL) reports before the open with an expected move of $2.13. EPS is estimated at -$0.01. Stock volume is 1.57 million, and options volume is 1,079 contracts.

Victoria's Secret (VSCO) reports before the open with an expected move of $2.59. EPS is estimated at $0.09. Stock volume is 2.56 million, and options volume is 10,992 contracts.

June 12

Adobe (ADBE) reports after the close with an expected move of $27.73. EPS is estimated at $4.01. Stock volume is 2.15 million, and options volume is 24,051 contracts.

RH (RH) reports after the close with an expected move of $25.33. EPS is estimated at -$0.09. Stock volume is 1.05 million, and options volume is 11,958 contracts.

Here are the economic events for the week (reminder, we added a Trump calendar seen here: https://unusualwhales.com/trump-tracker)

Here is the economic calendar this week. More at unusualwhales.com/economic-calendar:

Monday, June 9

7:00 AM PDT – Wholesale Inventories (April)

Previous: 0.0%

Tracks stockpiles held by wholesalers, key for assessing inventory buildup or drawdowns.

Tuesday, June 10

3:00 AM PDT – NFIB Small Business Optimism Index (May)

Previous: 95.8

Provides insight into small business confidence and outlook on hiring, pricing, and sales.

Wednesday, June 11

🧨 Big inflation day

5:30 AM PDT – CPI Inflation Report (May)

Core CPI YoY: Previous 2.8%

Core CPI MoM: Forecast 0.2%

Headline CPI YoY: Previous 2.3%

Headline CPI MoM: Forecast 0.2%

Major inflation reading closely watched by Fed and markets.

11:00 AM PDT – Monthly U.S. Federal Budget (May)

Tracks federal surplus or deficit for the month.

Thursday, June 12

5:30 AM PDT – PPI Inflation Report (May)

Core PPI YoY: Previous 2.9%

Core PPI MoM: Forecast -0.1%

Headline PPI YoY: Previous 2.4%

Headline PPI MoM: Forecast -0.5%

Tracks price changes at the producer level, often a leading indicator for consumer inflation.

5:30 AM PDT – Initial Jobless Claims (week of June 8)

Weekly labor market update, closely monitored for signs of weakening employment conditions.

Friday, June 13

7:00 AM PDT – University of Michigan Consumer Sentiment (Preliminary, June)

Previous: 52.2

Early read on consumer confidence, inflation expectations, and personal financial outlook.

🔎 Key Themes:

CPI on Wednesday and PPI on Thursday are the critical inflation drivers this week.

NFIB and consumer sentiment will give signals on business and household confidence.

Jobless claims remain key for any early signs of labor market softening.

Federal budget update offers a snapshot of government fiscal flows.

Thank you as always for reading and have a great week!