A tutorial on how to use options flow using Unusual Whales tools

As part of our weekly free educational series

Hey all,

This is the Unusual Whales Team, and we are going to spend every Wednesday walking you through some trades of the week for free to help your trading!

These educational tutorials will be options or equities focused to help you understand why or how interesting and useful trades were made, and how to utilize and read the various tools on Unusual Whales. If you like the tutorial, feel free to support the substack by subscribing!

In today’s issue, we’re going to cover two call traders on two separate companies from the first week of December. One trader longed Macy’s $M for a stellar profit, and we were even able to see where the trader most likely exited their position. The other trade we’ll cover occurred on Eyepoint Pharmaceuticals Inc. $EYPT; however, the positions on $EYPT may still be open at the time of writing.

To kick us off, let’s take a look at our Macy’s $M trader.

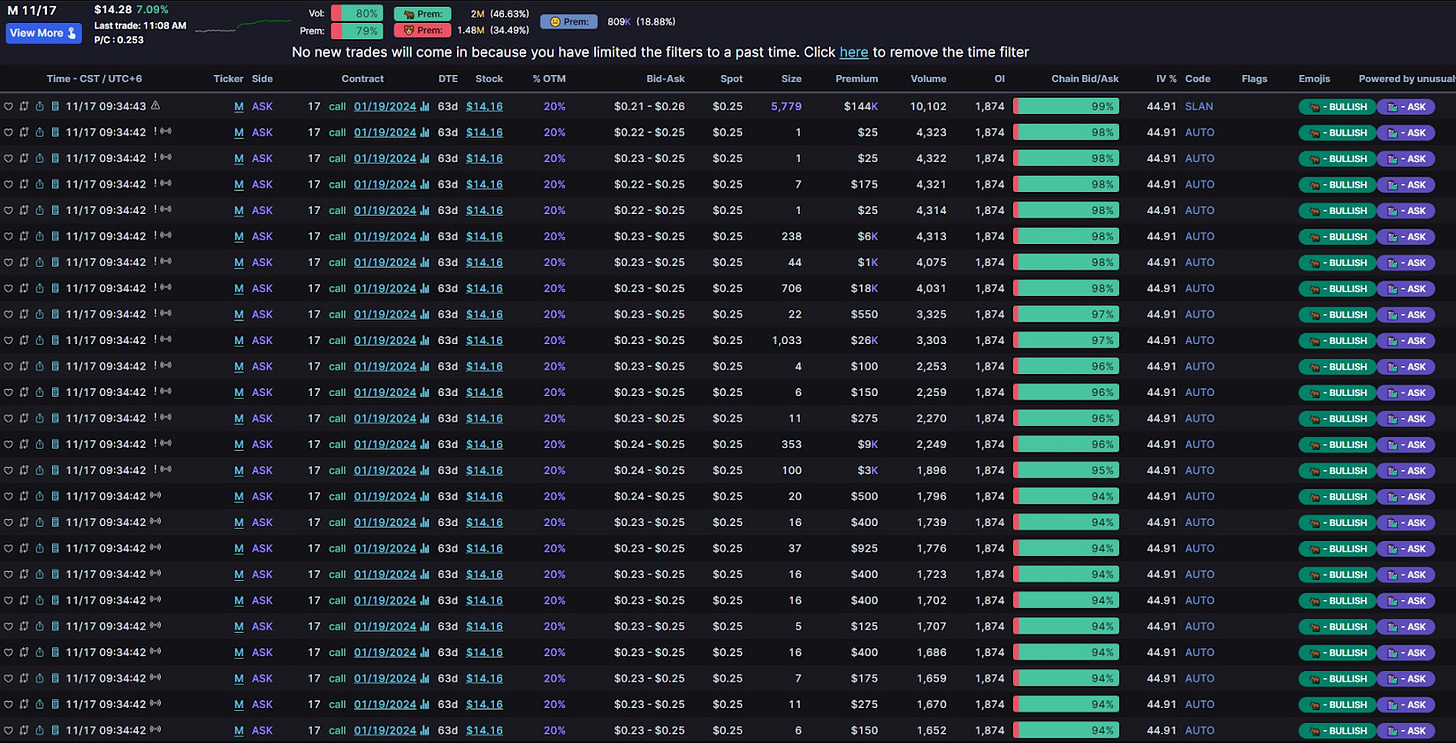

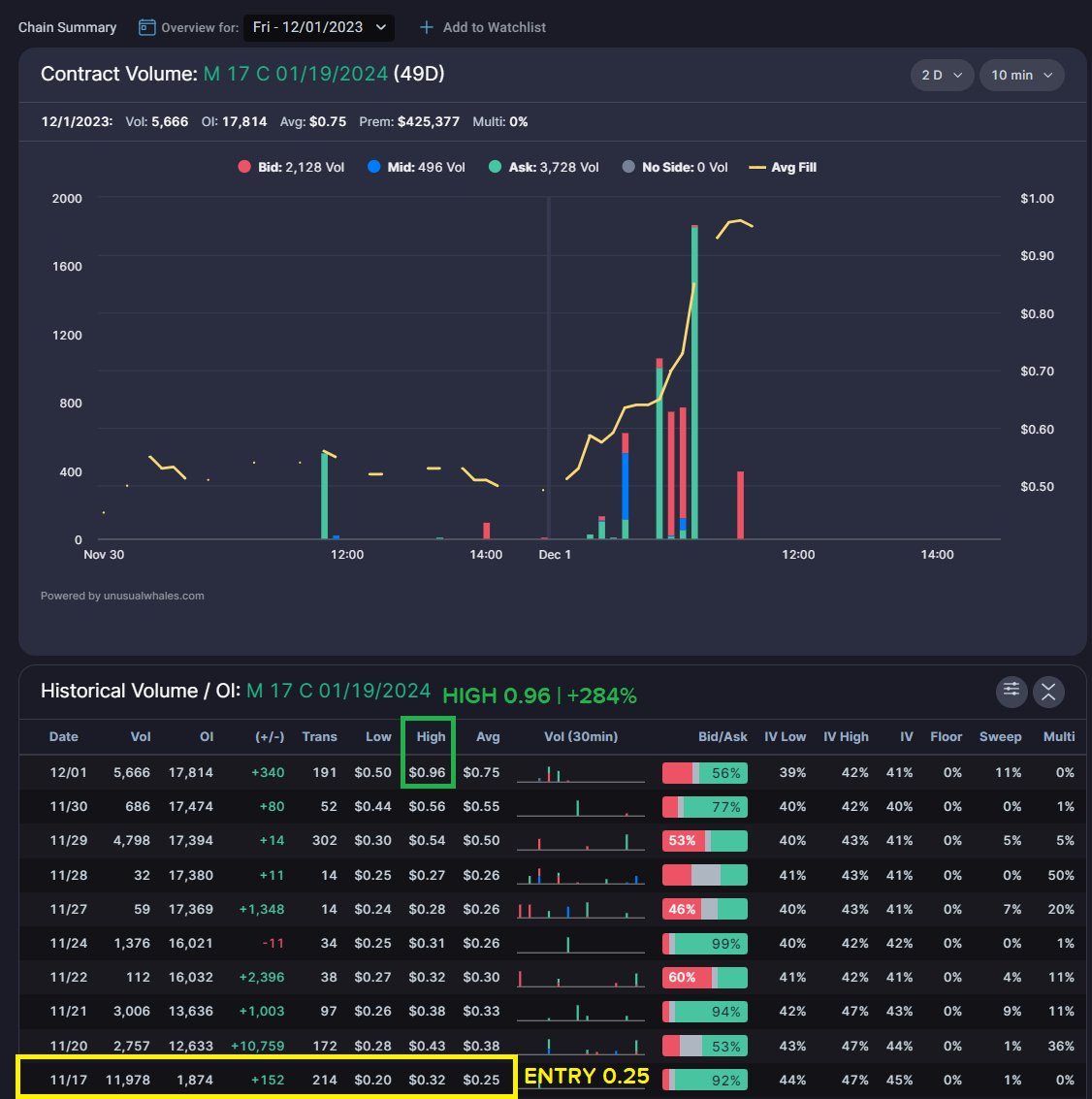

On Friday, November 17th at 09:34:42 CST we noted a spike in unusual options activity on the Macy’s $M $17C 1/19/2024 while Macy’s stock traded at $14.16 per share. First, a series of 52 orders totaling over 4,323 volume all at the ask price of $0.25 per contract. One second later, another 5,779 volume hit the tape in a single order.

It’s definitely possible that these orders came from separate traders, but one could argue both sets of orders came from the same trader due to the time and fills of the contracts. With that in mind, we’ll navigate this trade using the total number of contracts traded between 09:34:42 and 09:34:43 CST, which totals 10,102 contracts.

Over the next week 7 days, our trader’s position chopped between breakeven and modest profits–but they held their position. Our trader had already doubled their money when the contracts hit $0.56 on 11/30/2023, and once again, they held their position (which we know, due to the lack of change in the open interest of the contract). The contracts made their next big move going into Friday, December 1st when the contracts hit a new high of $0.96. That day, 5,666 contracts transacted, and the fills suggested the possibility of a partial exit on this position.

However, our trader once again held their position into the weekend. Their trade came to fruition on Monday, 12/04/2023.

By Monday December 4th, Macy’s $M stock had risen enough to put these $17C in the money. At 09:57:45, we noted a significant number of bid-side transactions on the contract, totaling 7,000 volume, at $1.25 per contract. Given the nature of these fills, it appeared our trader had finally taken profit on their position (though it’s possible 3,000ish contracts remained open). We confirmed the exit of these 7,000 contracts the morning of 12/05 when open interest updated to show us these contracts indeed closed.

Even though the Macy’s $M trader didn’t get out at the contract high ($1.45, a 480% gain from the point of entry), they still made a handsome profit for themselves. From their entry of $0.25 on 11/17, our trader closed 7,000 contracts at $1.25 on 12/4.

The trader initially spent $252,550 on their position of 10,000 contracts. They sold 7,000 for their 400% gain, profiting $622,450 with roughly 3,000 contracts still open and in profit. Even if those 3,000 contracts expire worthless, our trader has already pocketed significant gains.

The next trade highlight we’ll cover, pictured above, occurred on Eyepoint Pharmaceuticals Inc. $EYPT. Now, there were two notable strikes transacted the same day, the $7.5C and $10C both for 12/15/2023. However, the $7.5C were CROSS trades, so even though they filled at the ask price and we speculate they were bought to open, the nature of the trade gives us pause (read more about CROSS trades here). With that in mind, we’re only going to focus on the $10C 12/15/2023 for simplicity’s sake.

At 13:32:54 CST on Friday, December 1st, 604 contracts of the $10C 12/15/2023 transacted at the ask price of $1.90 per contract for a total premium of $114,750. $EYPT stock traded at $6.41 per share at the time of these transactions. By the end of the day Friday, there was no indication that our trader exited; so it’s no surprise that the open interest updated on Monday 12/5 to reflect the still-open position. This is where things get spicy for the stock and our trader.

On the morning of Monday, 12/4/2023, EyePoint Pharmaceuticals announced extremely positive results from the Phase 2 Trials of a drug geared toward treating retinal degeneration in humans. Investors frenzied over this, driving the stock an astounding +222% overnight.

In a Twitter post, Unusual Whales affiliate GGG tracked the trade, noting the 200%+ gain on Monday morning. The contracts themselves went ballistic.

Following the Phase 2 Trial results announcement, $EYPT overnight jumped from $6.76 per share to $21.82. The $10C 12/15/2023, now deep in the money, hit a high of $12.42 per contract that morning. However, watching the open interest in the days that followed, we can see our trader remained in their position–there was simply no volume to indicate any closure of these contracts. Perhaps the trader will eventually execute these contracts and own a significant number of shares at $10 per share. Perhaps they’ll sell the contracts prior to expiration. Either way, our trader made a hefty buck on their biopharma trade, taking their contracts from a $1.90 entry to a high of $12.42 | a +554% gain.

So, let’s recap:

$M $17C 1/19/2024 | $0.25 → $1.25 | +400% (POSITION CLOSED)

$EYPT $10C 12/15/2023 | $1.90 → $12.42 | +554% (POSITION STILL OPEN)

(Note: Biopharma is a particularly volatile sector due to the speculative nature and dramatic responses to Trial data. It’s very likely for the opposite of what happened with $EYPT to happen–just as easily as $EYPT reported positive data and spiked in share price, a bad report could drop one of these cheaper Biopharma stocks by factors of 50-70% overnight. Trading or investing in a Biopharma stock immediately prior to an announcement is highly speculative and high risk. Please do your own due diligence and research when considering trades of this nature.)

To clear up some of the terminology used in this article that you may not be familiar with, there are numerous educational resources on Options Basics, Misconceptions, Greeks, and Finding and Tracking Flow over on the Unusual Whales Education page!

Thank you as always for reading! I hope you find these types of articles helpful in your journey to learning how to read and interpret the flow and all the tools therein!

NOTE: This post is not financial advice. The stock market is risky, and any trade or investment is expected to have some, or total, loss. Please do research before any trade. Do not use this information for investment decisions. Check terms on site for full terms. Agree to terms before considering this information.

NOTE: Unusual Whales is not responsible for any promotion. It does not verify the authenticity of the promotion or partnership, nor the merits of the individual promotion. Unusual Whales does not necessarily endorse any one promotion. Please do your own diligence and research before following any one promoted post. Do not consider a promotion of a post an advocation for the sponsor of the post. Do not invest because of any promotion. Do not follow any promotion unless you yourself think it worthwhile. Unusual Whales is not affiliated with any sponsor. Unusual Whales is being paid to promote the promotion. The post itself is an ad, and not a reflection of Unusual Whales itself. Please check full terms for details.